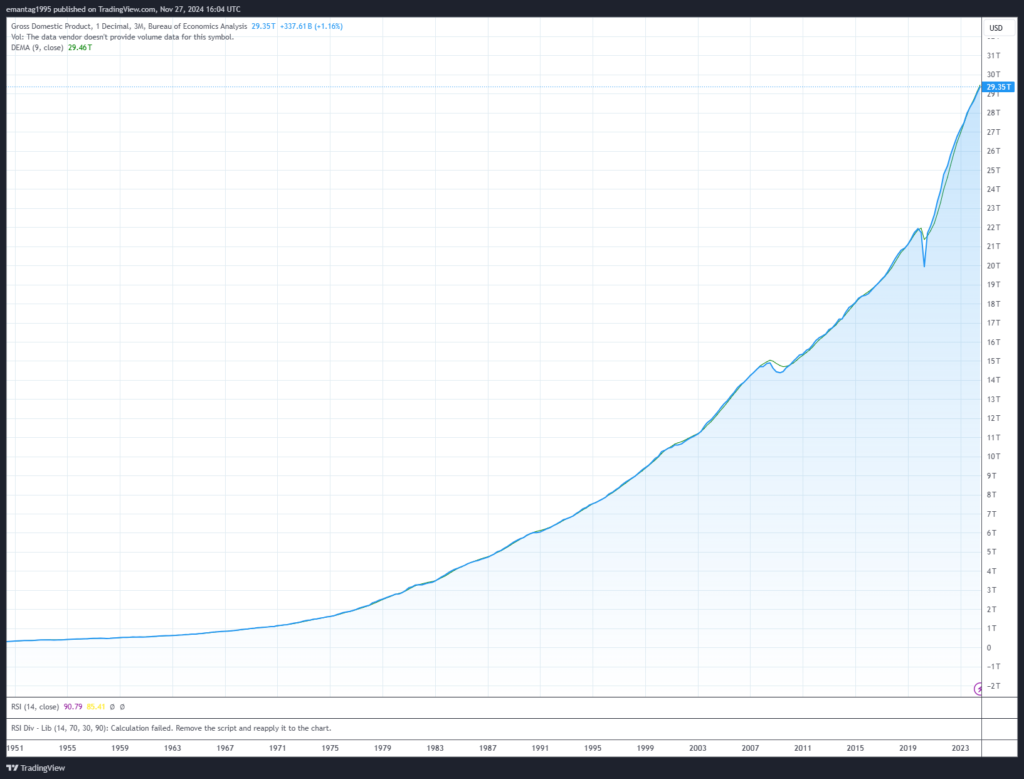

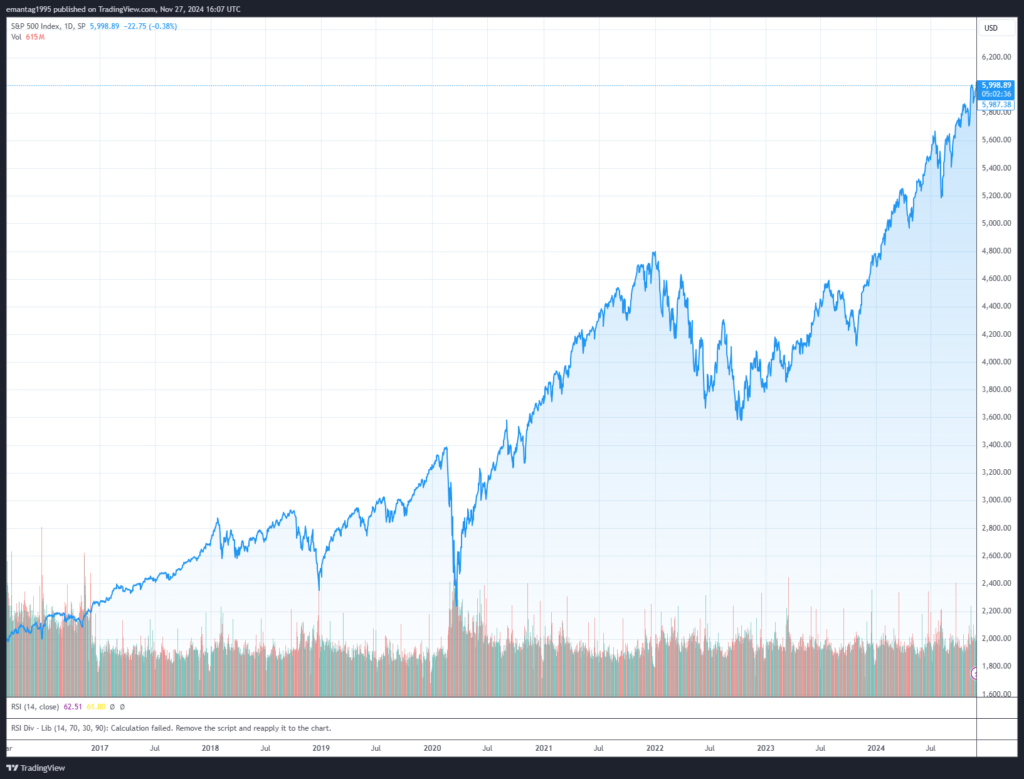

For the first time in two years, JPMorgan Chase & Co. has revised its outlook for the S&P 500, predicting an 8% rise in 2025. This optimistic shift follows a period of bearish forecasts and reflects confidence in the resilience of the US economy, which expanded at an annualized rate of 2.8% in the third quarter of 2024.

US Economic Growth Driven by Consumer Spending

The Bureau of Economic Analysis reports that consumer spending, the cornerstone of the economy, grew by 3.5% in Q3, its strongest performance this year. Investments also showed mixed results: nonresidential investment climbed 3.8%, while residential investment continued to decline, falling 5%. Corporate profits remained stable, with profit margins for non-financial corporations inching up to 15.6%.

Inflation appears to be cooling, as the Federal Reserve’s preferred metric, the Personal Consumption Expenditures (PCE) Price Index, increased by just 1.5% during the quarter. Core PCE, which excludes food and energy, rose by 2.1%, suggesting progress in the fight against inflation.

JPMorgan’s New S&P 500 Target for 2025

JPMorgan’s strategists, led by Dubravko Lakos-Bujas, now project the S&P 500 to reach 6,500 next year, an 8% increase from its current level of 6,021.64. This turnaround follows the departure of Marko Kolanovic, who had previously maintained a bearish stance.

The firm expects S&P 500 earnings per share to hit $270 in 2025, reflecting 11% growth, slightly below consensus estimates of $275. However, strategists caution that risks such as geopolitical tensions, uneven inflation trends, and global economic divergences remain.

Trump’s Economic Policies Boost Market Optimism

Donald Trump’s return to the White House has fueled optimism in the markets. Proposed policies, including corporate tax cuts and tariffs on Chinese imports, are expected to bolster corporate profits. However, economists warn that such measures may increase inflationary pressures in the long term.

Sector Outlook for 2025

JPMorgan is overweight in financials, communications services, and utilities, while underweight in energy and consumer discretionary. Other sectors remain neutral as the bank advises a flexible investment approach amid expected market dispersion.

Resilient Economy Faces the Future

Despite challenges like high borrowing costs and political uncertainty, the US economy has proven its durability. As inflation continues to cool and the Federal Reserve eases interest rates, markets appear well-positioned for steady growth. With strong consumer spending and renewed confidence in equities, the outlook for 2025 remains optimistic, though not without risks.

This dual narrative of economic strength and market recalibration sets the stage for a dynamic year ahead. Both investors and policymakers will need to navigate these shifts carefully to capitalize on emerging opportunities.