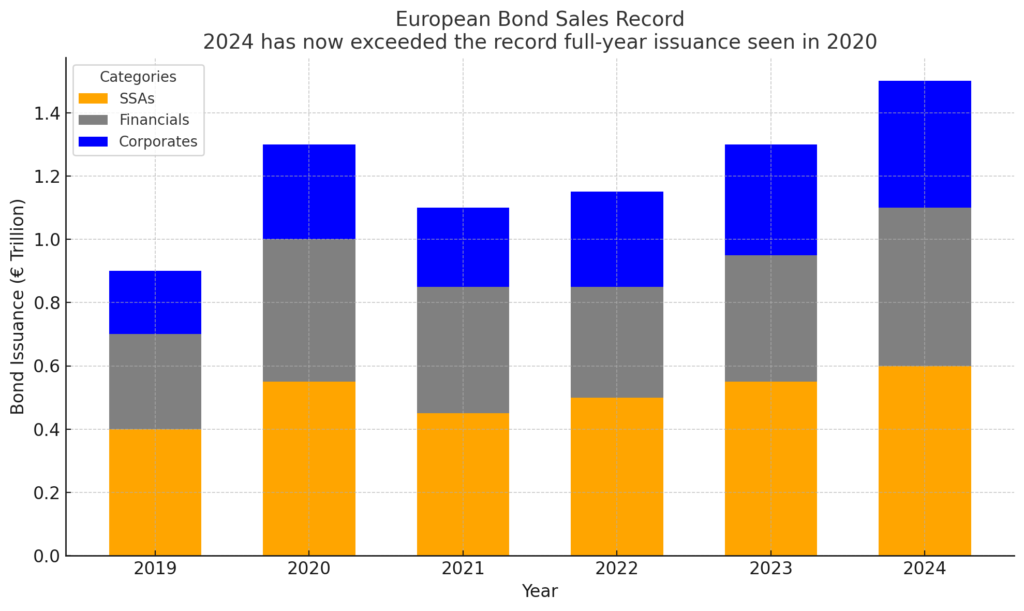

In a historic turn of events, the European bond market has surpassed €1.705 trillion in new issuances for 2024, marking an unprecedented record. While this achievement highlights the region’s financial resilience, it also raises serious concerns about the underlying state of Europe’s economy. Analysts are sounding the alarm, warning that this surge could be masking vulnerabilities that could lead to Europe’s economic downfall.

Unprecedented Growth or Warning Sign?

The milestone in Europe’s bond market reflects a robust appetite for debt issuances, but it also comes with significant risks. Cem Keltek, a credit strategist at Deutsche Bank Research, warns that a rapidly deteriorating European growth outlook and escalating U.S. tariff threats could disrupt the market. According to Keltek:

“The main risk to that would be a rapidly deteriorating European growth outlook and more comprehensive US tariff threats than the market is anticipating. That could weigh on broader market sentiment, shut primary market access temporarily, and could also see issuers reevaluate.”

Key Risks Facing Europe

Several challenges loom over Europe’s bond market:

- Weakened Economic Growth: The European economy is showing signs of slowing, putting pressure on market stability.

- Geopolitical Tensions: U.S. tariff policies could exacerbate trade disruptions, creating headwinds for European issuers.

- Issuer Reevaluation: Any significant downturn could force companies to pull back on funding plans, further straining the market.

Notable Bond Deals in 2024

Despite the uncertainties, Europe’s bond market has been buzzing with high-profile transactions. These deals showcase the diversity of issuers and the types of debt being sold:

- Green Bonds: Fingrid successfully raised €500 million through green bonds with competitive pricing spreads.

- Corporate Debt: Abanca issued a variety of Tier 2 bonds with maturities designed to attract yield-seeking investors.

- High-Yield Transactions: Asmodee secured funding through high-yield senior bonds, reflecting continued investor demand.

Why This Record May Signal Trouble

While €1.705 trillion in new bond sales seems like a triumph, analysts argue it could signal a peak before a decline. The combination of geopolitical tensions, slowing growth, and market volatility may lead to:

- Restricted access to bond markets.

- Increased borrowing costs for issuers.

- A potential liquidity crisis if investors pull back amid growing risks.

What This Means for Investors

For investors, Europe’s record-breaking bond sales present a mixed picture. On one hand, the surge in issuance reflects strong demand for debt, particularly in areas like green bonds and corporate debt. On the other hand, the market’s reliance on favorable economic conditions and stable geopolitical relations makes it vulnerable to shocks.

Key Considerations for Investors:

- Monitor Economic Data: Keep an eye on European GDP growth and inflation figures.

- Diversify Holdings: Hedge against risk by exploring investments in non-European markets or alternative asset classes.

- Stay Updated on Geopolitical Developments: Tariff policies and trade tensions can have a cascading effect on bond markets.