Visa and Mastercard are under fire for their staggering profit margins, which far exceed those of merchants and other industries, raising questions about competition and fairness in the U.S. credit card market. Critics argue that this imbalance reflects a lack of competition and fairness, with calls for legislative intervention through the proposed Credit Card Competition Act (CCCA).

Massive Profits Amongst Rising Fees

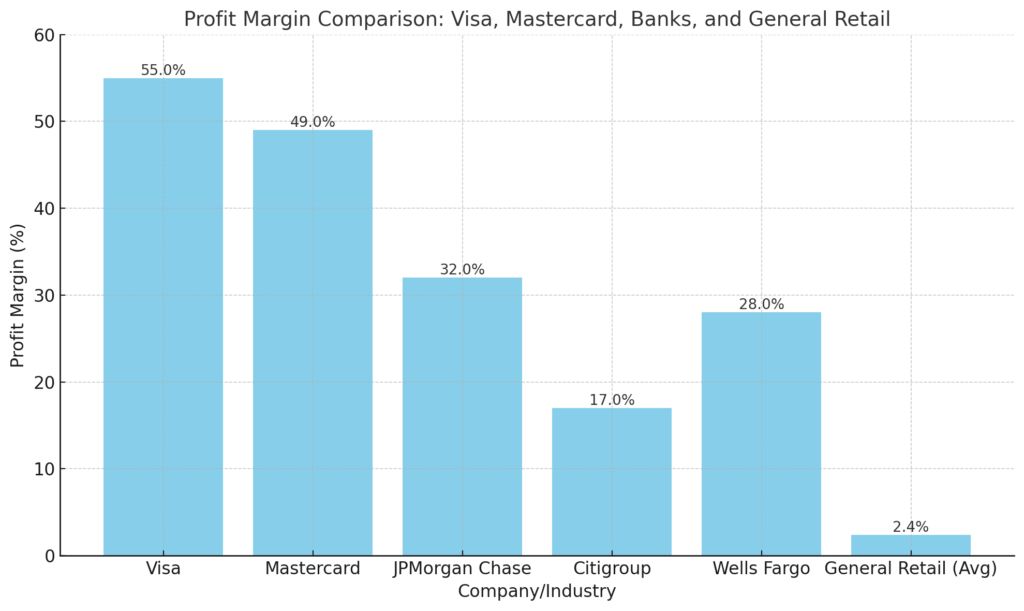

Visa reported a 55% profit margin in its latest quarter, with net income rising 19% to $4.7 billion on revenues of $8.6 billion. For the full fiscal year, Visa maintained a 53% profit margin, generating $17.3 billion in net income. Mastercard followed suit with a 49% profit margin, reporting a 28% increase in net income to $3.2 billion on $6.5 billion in revenue.

In stark contrast, the average net profit margin for general retail businesses in 2022 was just 2.4%. Credit card-issuing banks also reported significant gains. JPMorgan Chase, the largest U.S. credit card issuer, posted a 35% increase in net income to $13.2 billion, achieving a 32% profit margin. Wells Fargo and Citigroup reported profit margins of 28% and 17%, respectively.

Swipe fees—charged to merchants for every card transaction—are a key driver of these profits. These fees, which average 2.24% but can climb as high as 4%, have doubled over the past decade, reaching a record $160.7 billion in 2023. For many merchants, swipe fees are the second-largest operating expense after labor, and their cost is often passed on to consumers through higher prices.

Who Pays These Fees?

Understanding who bears the cost of credit card fees highlights the imbalanced nature of the system:

- Merchants: Merchants pay swipe (interchange) fees to process credit card transactions. These fees are set by Visa and Mastercard, and a portion goes to the banks that issue the cards. Small businesses, in particular, struggle with these costs, often raising prices to offset the expense.

- Consumers: Consumers indirectly pay for swipe fees through higher prices on goods and services. They also directly pay interest on outstanding balances, late payment fees, annual fees, and other charges. Credit card interest rates typically range from 15% to 30%, significantly adding to the overall cost of credit.

- Issuing Banks: Banks like Chase and Citi pay licensing fees to Visa and Mastercard to use their networks but recover these costs through the fees and interest charged to merchants and consumers.

Proposed Reforms to Foster Competition

The CCCA aims to reduce these fees and increase competition by requiring large banks (with over $100 billion in assets) to allow card processing over at least two unaffiliated networks. This could save merchants and consumers $15 billion annually and reduce fraud rates, as alternative networks like NYCE, Star, or Shazam have significantly lower fraud levels than Visa and Mastercard.

Notably, the legislation would not impact credit card rewards programs or consumer behavior. Small credit unions and community banks would also be exempt, preserving their current operations.

What’s at Stake?

Critics argue that the current system benefits card networks and banks at the expense of consumers and merchants. Support for reform is strong, with 65% of likely voters favoring the CCCA. However, Visa and Mastercard have already raised swipe fees by an additional $500 million this year, intensifying the financial burden on businesses and consumers.

As profit margins remain historically high, the passage of the CCCA is being viewed as a critical step to level the playing field in the credit card industry. Whether Congress will act to address these imbalances remains an open question, but the debate continues to shed light on a system that disproportionately benefits its biggest players.