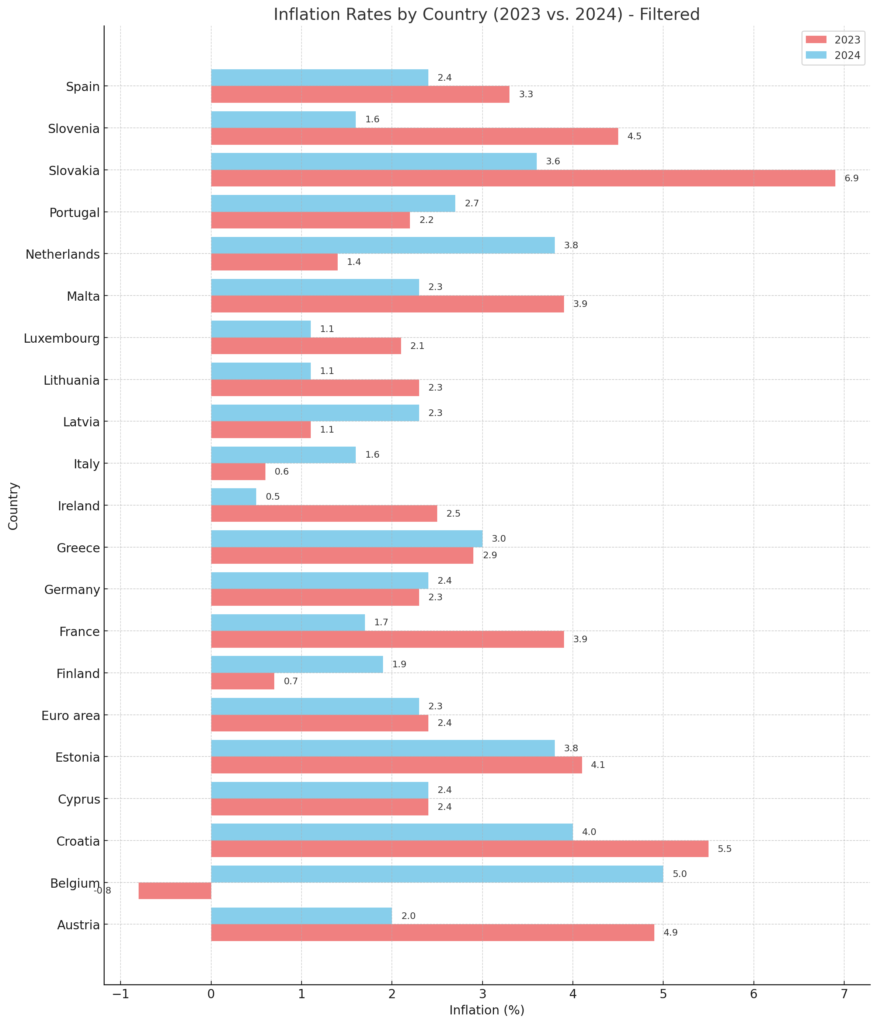

Eurozone inflation climbed to 2.3% in November, up from 2% in October, breaching the European Central Bank’s (ECB) 2% target. While expectations for a December rate cut remain strong, a growing divide among policymakers raises questions about how aggressively the ECB can continue easing monetary policy.

Inflation Data Adds Complexity

The latest Eurostat figures reveal an uptick in consumer prices, driven by steady increases in services and non-energy industrial goods. Core inflation, which excludes volatile food and energy prices, held firm at 2.7%. This mixed picture reflects both the challenges and the opportunities for the ECB as it aims to support a faltering economy while managing inflation pressures.

December Rate Cut: A Foregone Conclusion?

Market consensus points to a likely quarter-point rate cut at the ECB’s December meeting, reducing the deposit rate from 3.25% to 3%. Policymakers aim to move rates toward a neutral level of 2%, where they neither stimulate nor restrict growth. However, recent remarks from key ECB officials suggest the decision may not be as straightforward as markets assume.

Internal Debates Cloud the Path Forward

The ECB’s Governing Council is split over the pace and depth of future rate cuts:

- Dovish Proponents: Greece’s Yannis Stournaras and Portugal’s Mario Centeno advocate for aggressive rate cuts, arguing that inflation risks undershooting the target in the long term, especially given Europe’s weakening economic outlook.

- Hawkish Skeptics: Germany’s Joachim Nagel and others urge caution, citing persistent services inflation, rising wages, and geopolitical uncertainties that could keep inflation stubbornly high.

Schnabel Sounds a Note of Caution

Isabel Schnabel, a member of the ECB’s Executive Board, has warned against cutting rates too deeply. Speaking recently, she highlighted that borrowing costs are already near levels that no longer restrict economic activity. Further reductions, she cautioned, could destabilize markets or backfire in other ways, especially if inflation proves stickier than anticipated.

Schnabel’s comments reflect a growing concern that the ECB may be nearing the limits of effective rate cuts. Her view adds weight to the arguments of hawkish policymakers who fear that moving rates into overly stimulative territory could introduce new risks.

Market and Consumer Signals

Markets remain largely optimistic about rate cuts, with medium-term inflation expectations dropping below 2% for the first time since 2022. However, consumer surveys suggest that inflation concerns persist, with many expecting price growth to remain elevated over the next year.

Geopolitical Uncertainty Adds Pressure

Donald Trump’s re-election in the United States has added another layer of complexity to the ECB’s decision-making. Trade tariffs and geopolitical tensions could impact European growth, though their inflationary effects remain uncertain. ECB President Christine Lagarde recently suggested that tariffs might have a limited, short-term impact on prices.

Will the ECB Cut Rates Again?

The ECB faces a tough decision at its upcoming December meeting. On one hand, continued rate cuts could help bolster economic growth, particularly as inflation shows signs of stabilizing. On the other hand, persistent inflation in services and wages suggests that overly aggressive easing could do more harm than good.

Much will depend on the ECB’s updated economic forecasts, set to be unveiled in December. If inflation is projected to stabilize near the 2% target by early 2025, it could justify further cuts. However, if core inflation remains stubbornly high or geopolitical risks intensify, policymakers may lean toward a more cautious approach.

Conclusion

As markets brace for the ECB’s final policy decision of the year, the question remains: how far will the central bank go to support growth? While a December rate cut seems likely, increasing caution among key policymakers signals that the ECB may approach 2024 with a more measured strategy, leaving the door open for further debate in the months ahead.