As Donald Trump prepares to return to the White House, his administration is doubling down on tariffs, a cornerstone of his economic strategy. With new priorities and a revamped team, the potential impact of these trade measures on businesses, investors, and global markets is immense. Here’s a simplified breakdown of what to expect in Trump’s second-term trade war.

What’s Happening?

Trump’s administration is gearing up for a fresh wave of tariffs targeting China and other trade partners. These measures are part of a broader strategy to reshape global trade, protect domestic industries, and generate revenue to offset tax cuts.

Key highlights include:

- China in the Crosshairs: New tariffs could triple on Chinese imports by 2026, particularly targeting capital and intermediate goods.

- Global Impact: A smaller increase in tariffs will affect imports from other countries, focusing on goods less likely to raise consumer prices.

- Average Tariffs Rise: The US’s average tariff rate may climb from 2.6% to nearly 8% by the end of 2026, the steepest hike since the 1930s.

Why Tariffs?

For Trump, tariffs serve multiple purposes:

- Negotiation Leverage: Higher tariffs give the US a stronger position in trade talks with China and other nations.

- Revenue Generation: New tariffs could bring in $250 billion by 2026, helping offset the cost of extending Trump’s 2017 tax cuts.

- Reshoring Production: By making imports more expensive, tariffs aim to boost domestic manufacturing and job creation.

Impact on China and Global Trade

- China: With tariffs potentially rising to 75% on targeted goods, China’s trade with the US is expected to drop sharply, reducing its share of US imports by up to 83%.

- Canada and Mexico: As major US trade partners, they could face severe consequences from border tariffs tied to migration and drug policies.

- Global Trade: US imports and exports may decline by 11%, reducing the nation’s role in global trade.

What Businesses Should Watch

- Key Sectors: Capital and intermediate goods will bear the brunt of the tariffs, while consumer goods are likely to be spared to minimize inflation.

- Uncertainty: Trump’s unpredictable approach and preference for dramatic policy announcements make it challenging to plan for the long term.

- Supply Chains: Tariffs may disrupt global supply chains, increasing costs for businesses reliant on imports.

The Road Ahead

Under Trump’s plan, the first round of new tariffs is expected in mid-2025, with gradual increases through 2026. These measures align with his campaign rhetoric and are designed to pressure China while supporting domestic industries.

Trump’s economic team, including Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, is tasked with balancing tariff implementation against market stability. While Trump’s tariffs enjoy public support, his administration will need to address concerns about inflation and potential retaliation from trade partners.

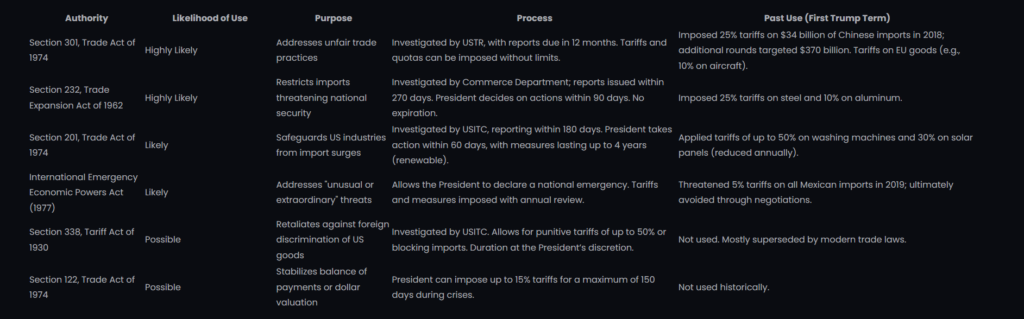

Recap of possibilities