The U.S. Treasury yield curve, specifically the spread between 2-year and 10-year yields, has recently begun to steepen, signaling heightened concerns in financial markets. Historically, a steepening curve often reflects either improving economic prospects or rising fears of economic instability. In this case, the latter seems to dominate, with the 10-year yield nearing the psychologically significant 5% mark.

Market Fears Heightened by Delayed Rate Cuts

A key source of market anxiety stems from the Federal Reserve’s expected policy trajectory. Despite persistent speculation of easing monetary policy, the Fed has not signaled any intention to cut rates during its January 2025 meeting. Compounding these fears, there will be no Federal Open Market Committee (FOMC) meeting in February, leaving investors to wait until March for further clarity on rate adjustments. This prolonged period of uncertainty has fueled concerns about tightening financial conditions and its potential drag on economic growth.

Why These Fears Will Likely Ease

While the current environment has sparked jitters, fears surrounding the steepening curve and rising yields are expected to subside. Historically, when markets have adjusted to periods of delayed Fed action, long-term yields often stabilize. Moreover, inflation has shown signs of softening, giving the Fed more leeway to pivot toward rate cuts later in 2025. This scenario could temper the steepening curve and relieve pressure on long-duration bonds.

Equities Remain a Strong Bet

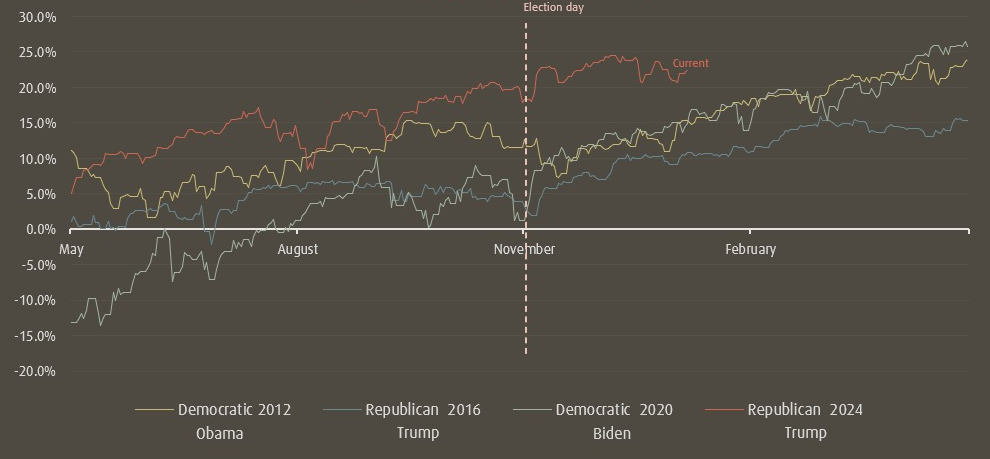

Amid the bond market volatility, equities, particularly large-cap stocks, continue to present attractive opportunities. Large caps are well-positioned to benefit from the Federal Reserve’s eventual pivot to rate cuts, expected by mid-2025. Furthermore, small- and mid-cap (SMID) stocks stand to gain from the pro-growth domestic policies anticipated under President Trump’s administration. His policy focus on deregulation and tax cuts could further stimulate domestic industries, bolstering SMID performance over the next 18 months.

Outlook: Stay the Course in Equities

For investors, the advice is clear: stay invested in equities. While the yield curve’s steepening reflects near-term fears, the broader market fundamentals remain robust. Large caps, with their defensive characteristics, offer stability, while SMID caps are poised for growth amid favorable domestic policies. By mid-2025, as the Fed potentially shifts toward a more accommodative stance, equities should deliver substantial returns, reinforcing their position as the preferred asset class.