Distributed Ledger Technology (DLT) is changing how financial systems work, making them faster, more secure, and more accessible. This technology, often referred to as blockchain, is behind innovations like cryptocurrencies and digital contracts. Let’s break down what DLT means for finance in simple terms.

How DLT is Changing Finance

Instant Payments

DLT allows payments to be processed almost instantly. For example, Ripple works with banks to speed up cross-border payments, making them quicker and more reliable.

Splitting Big Investments into Smaller Pieces

DLT can turn assets like stocks, bonds, or even real estate into digital tokens. These tokens can be divided into smaller parts, making it easier for more people to invest without needing a lot of money.

Digital Money from Central Banks

Many countries are testing digital versions of their money, called Central Bank Digital Currencies (CBDCs), using DLT. For example, the Hong Kong Monetary Authority is exploring ways to use DLT for secure and efficient digital payments.

Automatic Contracts

DLT enables “smart contracts,” which are digital agreements that automatically follow through when certain conditions are met. These are especially useful in areas like trade and finance because they save time and reduce errors.

Making Systems Work Together

Different DLT systems are being designed to work together smoothly, which helps businesses connect their technology more easily.

Questions About DLT

New Rules Are Needed

Governments are figuring out how to create rules for DLT that allow innovation while protecting people. The European Union is leading the way with its Markets in Crypto-Assets (MiCA) regulation.

Balancing Privacy and Security

While DLT provides strong security, there are concerns about privacy, especially when using public blockchains. New tools are being developed to address these concerns.

Can DLT Work With Traditional Finance?

People disagree on whether DLT should replace traditional banking or simply improve it. Some think it might be too complicated, while others see it as the future of finance.

Benefits of DLT for Everyone

Lower Costs

DLT removes the need for middlemen, reducing transaction costs and saving money.

Clearer Records

Transactions on a blockchain can’t be changed, providing a clear history for auditing and improving processes like anti-money laundering (AML) checks.

Safer Transactions

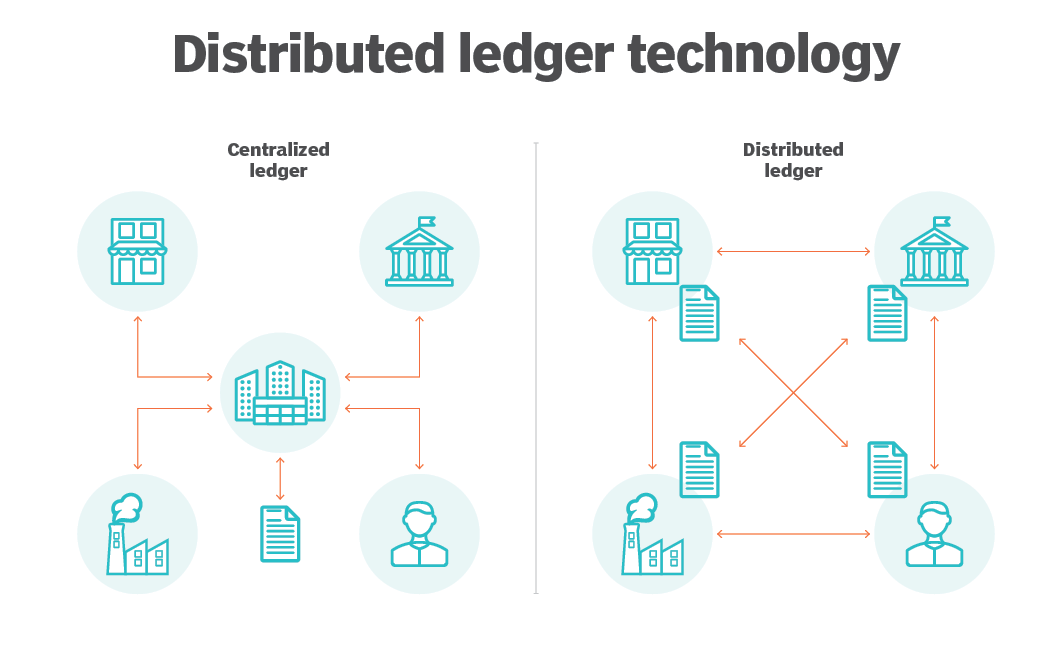

Since DLT is spread across many computers, it reduces the risk of fraud or one party not holding up their end of a deal.

Financial Services for All

DLT can help bring banking services to people who don’t have access to them, especially in remote areas, using mobile phones.

Challenges That Remain

Although DLT has many benefits, there are still challenges. These include unclear regulations, immature technology, and the need for consistent rules across different countries. Overcoming these challenges will help DLT reach its full potential.