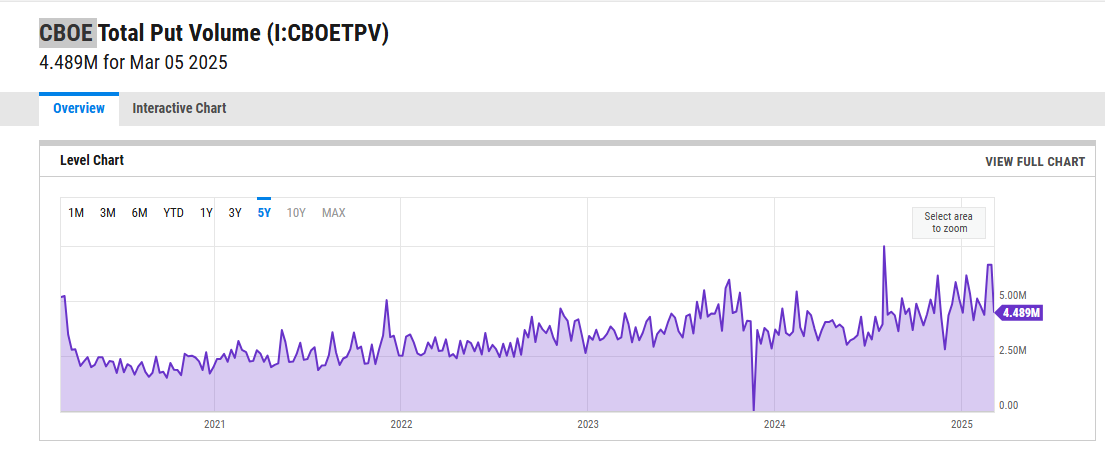

On March 4, 2025, the CBOE Total Put Volume surged to 6.18 million contracts, marking the second-highest level in the past five years. This level of put activity exceeds the total volume recorded throughout 2022, raising questions about potential market implications.

Historically, extreme spikes in put volume have often been associated with market reversals rather than prolonged downturns. The last time put volume exceeded this threshold, the S&P 500 rallied over 1,000 points from 5,100 to 6,100. Some analysts are now speculating that a similar pattern could emerge, with projections suggesting a potential move toward 7,050.

- Investor Sentiment and Market Positioning

A surge in put volume typically reflects increased hedging activity or bearish speculation. However, when put volume reaches extreme levels without a corresponding market decline, it may indicate excessive fear and a potential contrarian buying opportunity. - Market Makers and Liquidity Dynamics

When traders aggressively purchase put options, market makers—who sell these contracts—often hedge their risk by shorting the underlying assets. If the anticipated downturn does not materialize, these short positions must be unwound, which can drive significant upward momentum in the market. - Historical Precedents

Previous instances of extreme put volume spikes have often preceded market rebounds. While past performance is not indicative of future results, the recent surge in put activity raises the possibility of a similar market reaction.

While the data suggests a potential market shift, external factors such as macroeconomic conditions, Federal Reserve policy decisions, and corporate earnings must also be considered. A high put volume alone does not guarantee a rally, but it may serve as an indicator of sentiment extremes that could influence future price movements.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investors should conduct their own research before making any investment decisions.