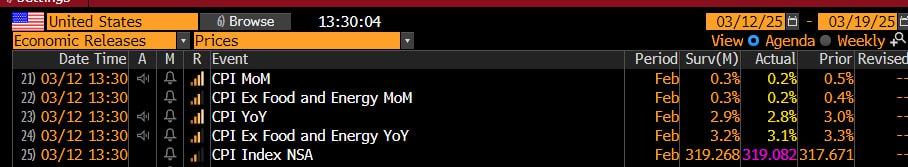

The U.S. stock market is seeing a strong rebound in futures and pre-market trading following a better-than-expected Consumer Price Index (CPI) report. Inflation data came in lower than anticipated, easing investor concerns about the Federal Reserve’s interest rate path. This has fueled optimism among traders, driving up futures contracts on major indices such as the S&P 500, Nasdaq, and Dow Jones.

With inflation showing signs of moderation, the market is now pricing in a more favorable economic environment. While risks still remain, including potential rate adjustments and macroeconomic uncertainties, current market levels appear to be undervaluing the improving conditions. For investors willing to encounter some volatility, this could present an attractive buying opportunity.

Despite the positive momentum, it is important to recognize that market fluctuations are likely to persist. The Federal Reserve’s stance on future rate cuts and ongoing global economic developments could introduce sharp swings in asset prices. However, for those with a longer-term perspective, the current pullback in equity prices may offer an advantageous entry point.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research (DYOR) before making any investment decisions.