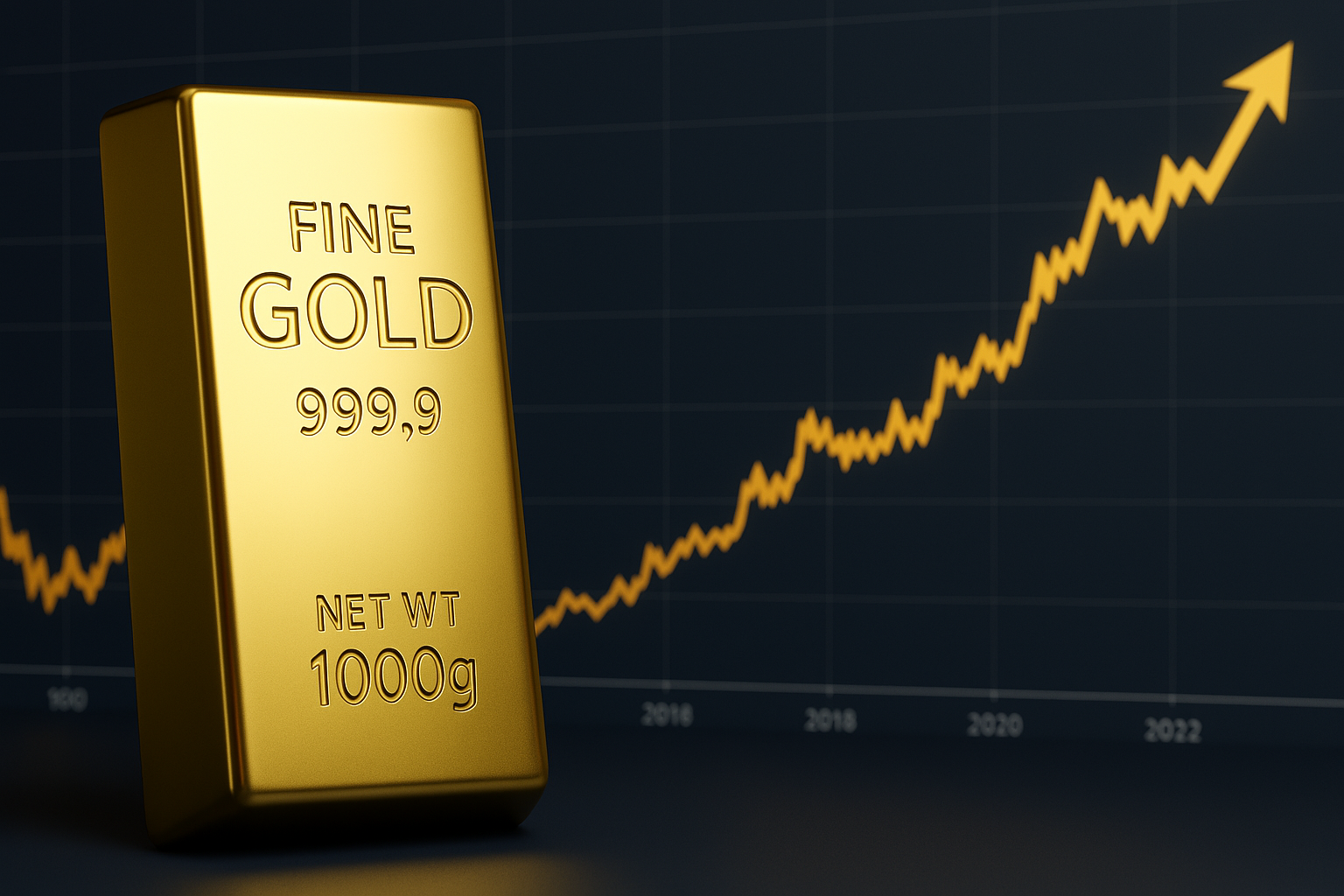

Gold’s journey through modern financial history tells a compelling story—one marked by calm during economic clarity and brilliance during financial turmoil. In 2000, gold was barely on anyone’s radar, averaging just $270 per ounce. Fast forward to 2008, during the peak of the global financial crisis, it climbed past $870 and soared beyond $1,000 in early 2009, eventually peaking around $1,900 in 2011. Now in 2024, with prices already breaching the $2,100 mark, the precious metal may once again be preparing for a significant run. Is history about to repeat itself?

In 2000, the global economy was stable. The dot-com bubble was still inflating, but gold remained subdued. Investors had little need for safe havens. But by 2008, the picture changed drastically. As banks collapsed and market panic spread, gold became the ultimate refuge. The Federal Reserve’s emergency actions—slashing interest rates and initiating quantitative easing (QE)—pushed trillions into the system, devaluing the dollar and stoking fears of inflation. Investors fled to gold, driving its price to new heights.

Now in 2024, several signals suggest we might be walking a familiar path. Economic warning lights are flashing—yield curve inversions, weak growth, and jittery markets are all reminiscent of pre-2008 conditions. The Federal Reserve, after a fierce campaign of rate hikes to tame inflation, has started hinting at policy reversals. If it cuts rates or reintroduces QE, the flood of liquidity may weaken the dollar and lift gold even further.

Adding to the déjà vu is the looming “Everything Bubble.” Stocks, real estate, and even bonds appear overvalued. Should this bubble pop, investor fear could explode, triggering a rush to safe-haven assets like gold. Historically, gold thrives in such moments—when uncertainty meets accommodative monetary policy.

However, 2024 isn’t a carbon copy of 2008. Several differences could influence the trajectory. For one, global debt levels are far higher today. Public and private borrowers are stretched thin, and a downturn could hit harder, enhancing gold’s appeal. Another factor is the rise of cryptocurrencies. Bitcoin is often called “digital gold,” but its volatility and regulatory challenges make traditional gold a safer bet for many.

Moreover, central banks around the world are more coordinated now than in 2008. This synchronization could help stabilize markets—or exacerbate volatility if collective missteps occur.

Despite these unique factors, gold’s fundamental strengths remain intact. It provides safety when financial trust breaks, acts as a hedge against inflation, and carries no counterparty risk. If the Fed pivots again and launches new liquidity measures, gold’s upward momentum could mimic the powerful post-2008 rally. Some analysts even predict levels reaching $2,500 or beyond.

While no two financial periods are identical, the past offers valuable clues. Gold has consistently lagged in times of economic calm and surged during crises—especially when central banks react with aggressive stimulus. Today’s signals suggest 2024 may be another chapter in that recurring theme.

The world may be evolving, but when fear rises and currencies falter, gold continues to sing a familiar tune.