The recent U.S. announcement of reciprocal tariffs has stirred global headlines, prompting concerns of a trade war revival. But look closer, and it’s evident this isn’t about chaos—it’s calculated. The markets, bond yields, and macro data all point in one direction: this is a tactical move designed to pressure the Federal Reserve to cut rates, and the strategy is already showing signs of success.

While the surface-level reaction suggests trade aggression, the S&P 500 and Nasdaq-100 (NDX) have shown resilience. After a brief dip, markets rebounded, and more notably, U.S. 10-year Treasury yields dropped to around 4.05%, signaling investor belief that a monetary policy shift is incoming. This move fits perfectly into a broader macro play: use inflationary trade pressure to provoke a dovish pivot from the Fed.

The Real Tariff Story: Restoring Balance, Not Starting Fights

A chart titled “Reciprocal Tariffs” reveals how countries like Vietnam (90%), Cambodia (97%), and Sri Lanka (88%) have long maintained punitive tariffs against the U.S., while America reciprocated with significantly lower barriers. The new policy seeks to rebalance this by implementing reciprocal treatment—still at discounted levels—aimed at correcting trade imbalances and incentivizing domestic investment.

And the market sees it. Inflows into U.S. assets are likely as capital redirects away from overprotected economies and into one signaling long-term structural strength. This is not a move of desperation—it’s a show of confidence.

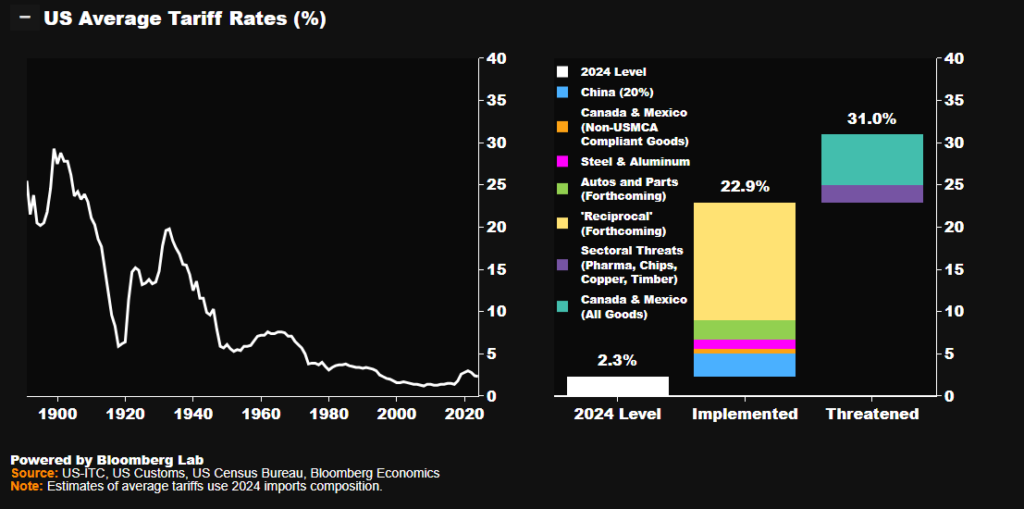

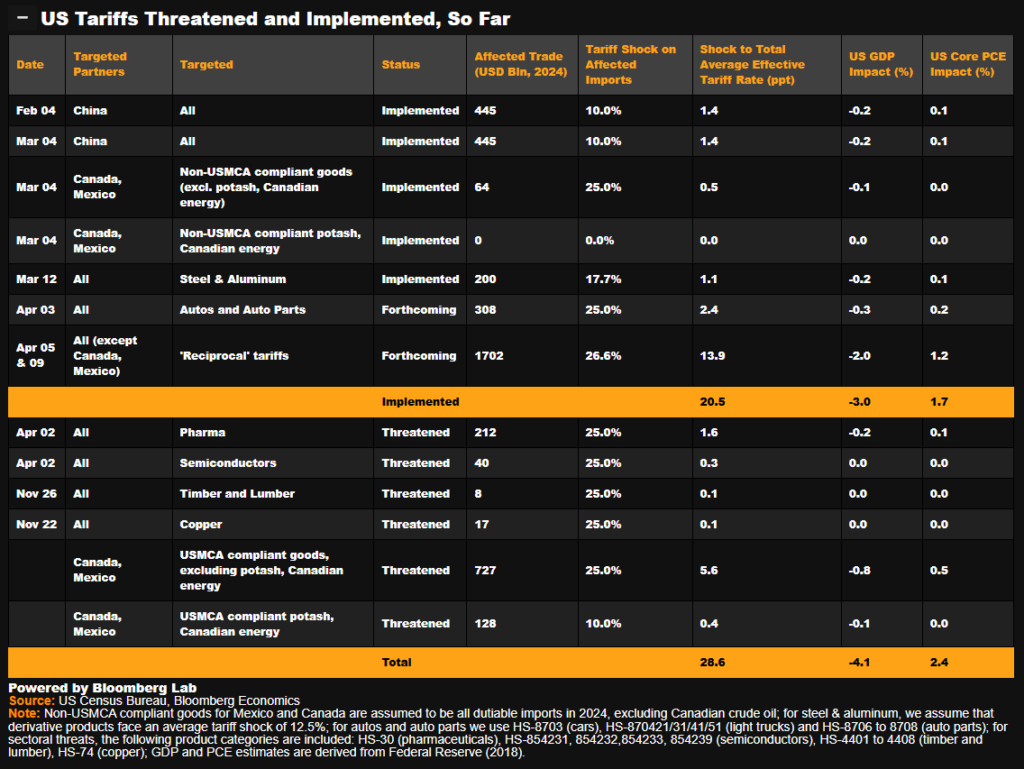

Bloomberg’s chart on U.S. average tariff rates shows that 2024 levels were historically low at just 2.3%. With newly implemented tariffs, that number has climbed to 22.9%, and if threatened tariffs are enacted, we could see average tariff levels exceed 31%—a major shift.

Notably, the bulk of these increases come from:

- Reciprocal tariffs (affecting $1.7 trillion in trade)

- Forthcoming measures on autos, steel, and pharma

- Targeted sectors like semiconductors, timber, copper

While these measures could slow growth by up to -4.1% on GDP short-term, they also create upward pressure on inflation, with a 2.4% rise in PCE inflation expected. That combination is precisely the kind of macro mix that nudges the Fed to respond with rate cuts.

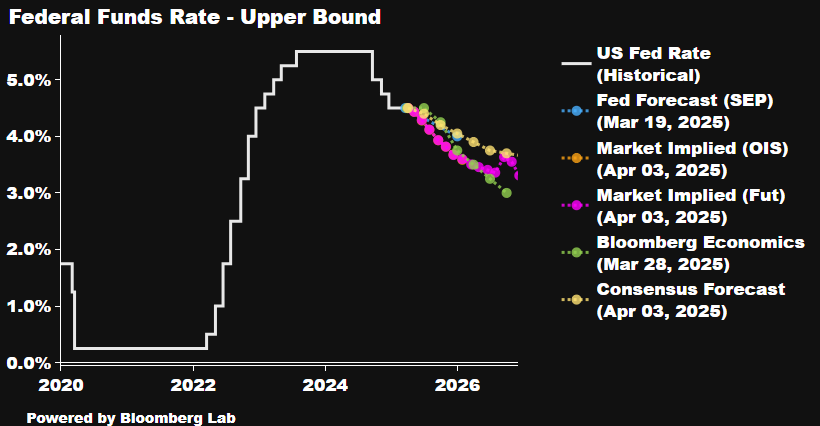

Fed is Already Leaning Dovish

Supporting this narrative is the most telling chart of all: the Federal Funds Rate forecast. As of April 2025:

- The Fed’s own projections, market-implied futures, and consensus forecasts all agree: rates are going down.

- The historical peak of 5.25% is already behind us.

- By mid-2026, the market is pricing in rates closer to 3.25%, with multiple cuts expected in the second half of 2025.

This is not speculation—it’s unfolding in real time.

A High-Conviction Market Opportunity

Markets often misinterpret bold policy as recklessness. In reality, strategic aggression accelerates outcomes. Yes, everything has a cost—growth may soften, and global partners may retaliate. But the endgame is stronger capital inflow, rebalanced trade, domestic industry resurgence, and a softer Fed.

This is a classic buy-the-dip setup, not just a gamble. With equity valuations still modest relative to long-term yields, and with a monetary pivot now aligning across the board, this may be one of the most attractive moments to enter the S&P 500 or Nasdaq-100 before the rebound steepens.

The noise is part of the strategy. And the strategy is working.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult with a qualified financial advisor before making any investment decisions.