Global trade is imbalanced: The U.S. carries an outsized burden by supporting the world economy through its reserve currency and open markets.

Overvalued U.S. dollar: High global demand for dollar reserves makes U.S. exports expensive and weakens domestic manufacturing.

Manufacturing decline: The current system contributed to offshoring jobs and hollowing out U.S. industrial capacity.

Geopolitical cost: While the U.S. gained influence, the economic costs have become too heavy to bear, especially for working-class Americans.

Trump-era trade policy is a blueprint: Tariffs and strong currency policies showed that restructuring is possible without triggering chaos.

Currency realignment is key: Preventing other countries from artificially holding down their currencies is necessary to fix trade imbalances.

Goal is rebalancing, not retreat: The U.S. doesn’t need to abandon alliances or reserve currency status—just demand more from global partners.

| Category | Perfect Currency Offset | No Currency Offset |

|---|---|---|

| Inflation | Noninflationary (USD price unchanged after tariff) | Inflationary (tariff cost passed to consumers) |

| Incidence | Paid by foreign nation via reduced purchasing power | Higher prices for consumer goods in domestic market |

| Trade Flows | Minimal trade flow impact; offset by regulatory reform | Rebalancing over time as imports become costlier |

| Revenue | High revenue raised by Treasury | Lower Treasury revenue due to reduced import demand |

What It Takes to Restructure the Global Trading System –

As the global economy grapples with new geopolitical realities, America’s approach to international trade is poised for dramatic transformation. At the heart of this shift lies a compelling argument: the current structure of the global trading and financial systems places an undue burden on the United States, particularly its manufacturing sector. The overvaluation of the U.S. dollar, driven by persistent demand for reserve assets, is a fundamental cause of this imbalance, diminishing American export competitiveness while encouraging dependency on foreign imports.

Historically, the U.S. embraced this role, reaping geopolitical benefits through its currency’s reserve status and the defense umbrella it provided allies. However, the cost of this privilege has risen sharply. As global GDP grows faster than that of the United States, maintaining this system has become more challenging. American manufacturing has suffered, jobs have moved offshore, and domestic communities have struggled to adjust. These consequences are no longer politically or economically sustainable.

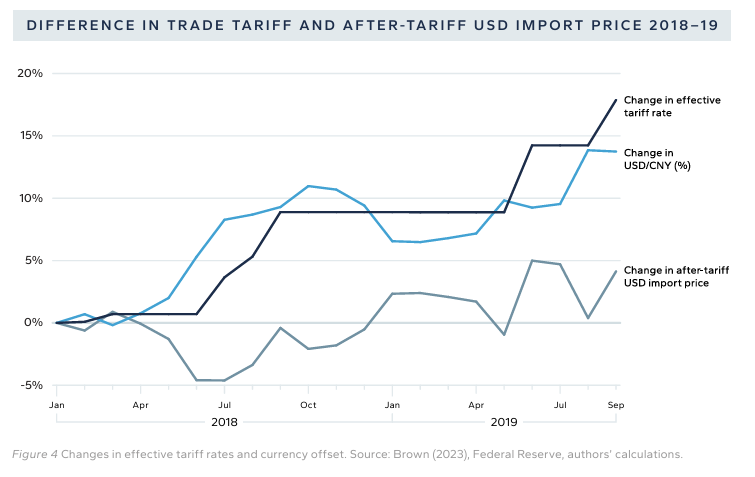

The Trump Administration, building on its first term’s experience, is expected to lead a restructuring of global trade through tools such as tariffs and currency policy. Contrary to popular belief, these instruments, if implemented carefully, need not trigger severe inflation or market chaos. In fact, the 2018–2019 tariff escalation demonstrated that if currency adjustments occur simultaneously, the inflationary effects are minimal. With tariffs offset by corresponding currency devaluations in exporting countries, the burden shifts away from American consumers and toward foreign producers.

Furthermore, tariffs can generate substantial revenue without significantly harming the economy. They also act as a form of “fiscal devaluation,” improving the relative attractiveness of domestic production. When combined with targeted deregulation and investment in key industries, such policies can stimulate job creation and increase economic resilience, particularly in sectors critical to national security.

On the currency front, unilateral and multilateral approaches are both on the table. A future policy could involve incentivizing reserve managers to shift from short-term to long-term U.S. debt, thereby easing pressure on Treasury markets and spreading the costs of reserve asset provision more equitably. Tools such as the International Emergency Economic Powers Act could be used to discourage excessive foreign reserve accumulation in dollars, further aligning currency values with trade fundamentals.

Volatility, of course, is a concern. But the path forward likely involves graduated implementation—rolling out changes slowly and conditionally, based on the actions of trade partners. This allows businesses and markets to adjust gradually while maximizing negotiating leverage. It also helps avoid sudden shocks that could destabilize financial systems.

At its core, the proposed restructuring is about restoring balance. It seeks to reduce America’s disproportionate responsibility for funding global trade and defense, while reinforcing its strategic position. This doesn’t imply abandoning alliances or reserve currency status—but it does mean asking more of international partners.