The House Republican tax bill, widely referred to as the One, Big, Beautiful Bill, has officially passed—marking a significant legislative victory aimed at strengthening the backbone of the American economy: small businesses.

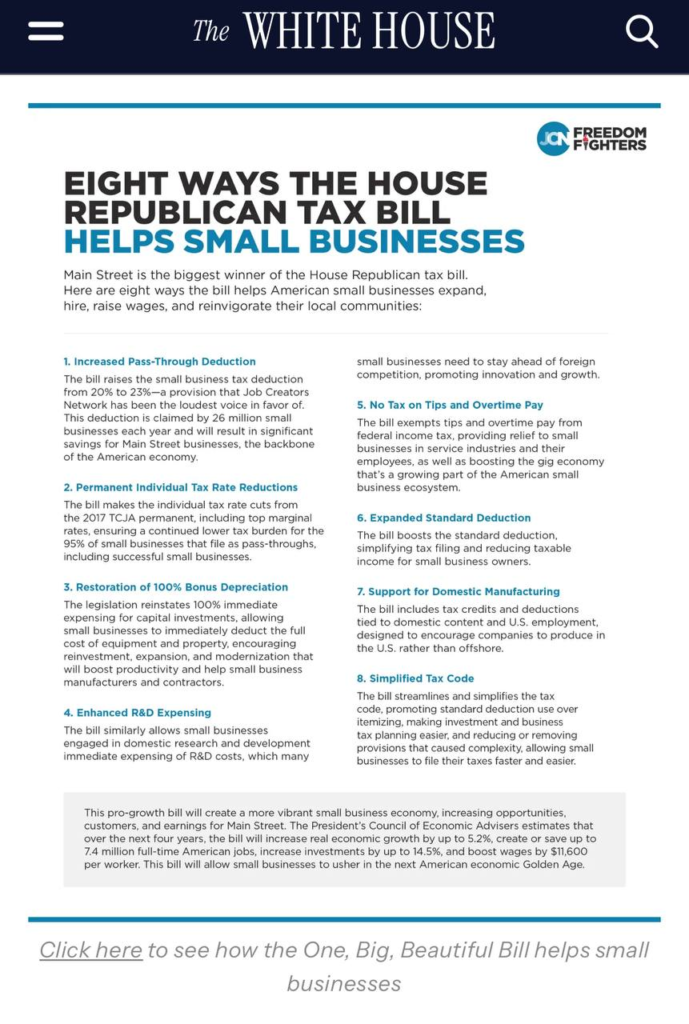

This newly enacted law delivers sweeping tax relief designed to support over 26 million small businesses nationwide. With provisions including an increased pass-through deduction, permanent individual tax rate reductions, full bonus depreciation, and simplified filing processes, the bill is set to dramatically reduce burdens on entrepreneurs and local employers.

The passage of this bill couldn’t come at a more crucial time. As inflationary pressures and global competition challenge Main Street, this tax overhaul provides small businesses with the tools and incentives needed to invest, hire, and grow. Additionally, domestic manufacturers and innovators will benefit from enhanced R&D expensing and production-focused tax credits, helping reinvigorate American industry.

From an investment standpoint, the passage of this bill also strengthens the case for small-cap stocks. These businesses—typically more domestically focused and tax-sensitive—stand to gain directly from the legislation. Investors may consider a small, measured allocation to small-cap equities, especially those poised to benefit from U.S.-centric growth trends and new tax efficiencies.

With the bill now signed into law, the stage is set for what many hope will be a new era of American small business prosperity. It’s a green light for entrepreneurs—and a subtle signal to investors to keep an eye on the next generation of growth coming from the heart of the economy.

One of the key features is the increased pass-through deduction. By raising the deduction from 20% to 23%, this bill significantly reduces tax burdens for over 26 million small businesses. This directly translates into more capital for expansion, hiring, and wage increases.

The bill also makes individual tax rate reductions permanent for most small businesses that file as pass-throughs. With more predictable and lower rates, owners can make long-term decisions with greater confidence.

Further benefits come from the restoration of 100% bonus depreciation and enhanced R&D expensing. Small businesses can now fully and immediately deduct the costs of new equipment and research investments. These incentives promote reinvestment, modernization, and technological advancement, keeping American businesses ahead of the curve.

The removal of federal income tax on tips and overtime pay benefits service-oriented enterprises and their employees. Alongside the expanded standard deduction and simplified tax code, the bill cuts down on paperwork and complexity, giving business owners more time to focus on growth instead of forms.

Support for domestic manufacturing is also included, with tax credits and deductions aimed at strengthening U.S.-based production. This could trigger a resurgence in local manufacturing, especially among small contractors and suppliers.

The cumulative effect is expected to be strong. According to the President’s Council of Economic Advisers, this bill could create up to 7.4 million full-time jobs and increase investments by up to 14.5%. Wages could rise by over $11,000 per worker. These are bold projections, but even partial realization would mean substantial benefits for the small business ecosystem.

For investors, this moment presents a strategic opportunity in small-cap equities. Small-cap companies—typically those with market capitalizations between $300 million and $2 billion—are highly sensitive to changes in the domestic economy. With lower taxes, easier regulations, and stronger demand, many of these firms stand to benefit significantly from the bill’s provisions.