The U.S. faces a looming financial reckoning, with public debt ballooning at an alarming rate. A bold goal of $2 trillion in yearly savings has emerged as a potential lifeline, but achieving this target requires urgent action and unprecedented discipline. Without it, the nation’s economic foundation may falter.

The Debt Timeline: From Reagan to Today

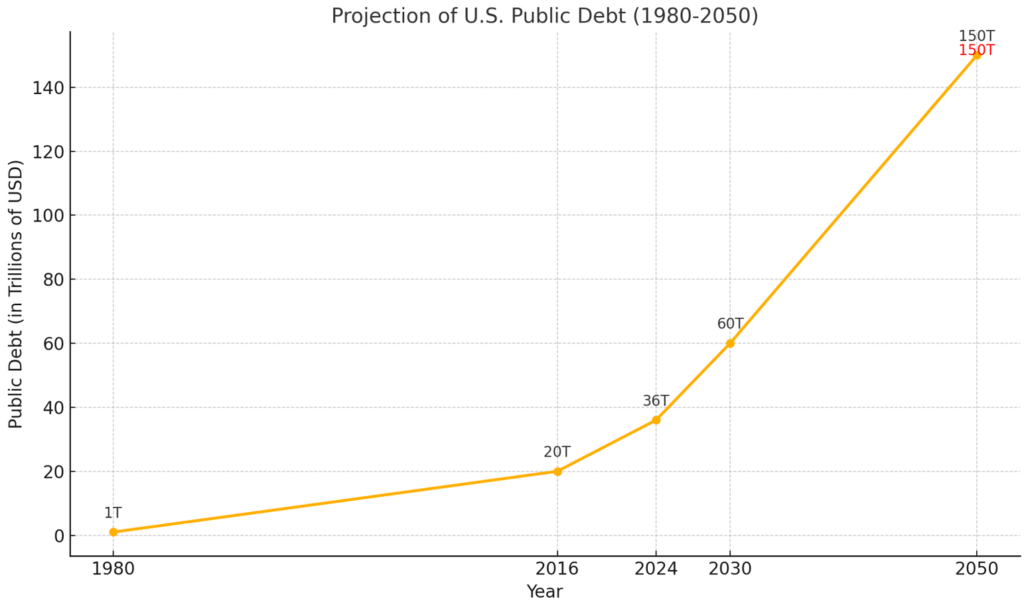

Back in 1980, under President Ronald Reagan, the public debt stood at $1 trillion, a figure driven by the push to rein in inflation. Fast forward to 2016, the year Donald Trump first assumed office, and that number had surged to $20 trillion. Today, the debt has skyrocketed to $36 trillion—and projections suggest that if spending continues unchecked, it could reach $60 trillion by the end of this decade.

What’s at Stake?

Beyond the staggering numbers, the rising debt poses a significant threat to the nation’s financial stability. As interest rates climb, the cost of servicing this debt grows exponentially, setting the stage for a vicious cycle. Current estimates from the Congressional Budget Office (CBO) paint an even grimmer picture: public debt could soar to $150 trillion by 2050, assuming the U.S. avoids recessions, inflation spikes, or new fiscal policies. But this is a dangerously optimistic scenario. Long before reaching such unsustainable levels, the system could implode.

The $2 Trillion Solution

Here’s where the $2 trillion annual savings goal comes into play. Recently highlighted by prominent voices in business and politics, this target reflects the urgency of substantial fiscal reform. However, misunderstandings abound. Some have incorrectly interpreted this figure as a decade-long savings goal. In truth, $2 trillion over 10—or even five—years would hardly move the needle.

The advocates of this strategy, including entrepreneurs and policymakers, emphasize the need for immediate, yearly savings to prevent the debt crisis from spiraling out of control. As one prominent advocate put it during a rally, delaying action risks reducing this bold ambition to a mere accounting exercise.

Why This Matters Now

The stakes couldn’t be higher. If the current trajectory persists, the debt could reach 166% of GDP within 25 years, destabilizing the economy and threatening the nation’s global standing. Addressing this challenge isn’t just about numbers—it’s about preserving the economic structure that underpins American prosperity.

The call for $2 trillion in annual savings isn’t just a lofty goal; it’s a necessary step to safeguard the future. The question now is whether Congress, policymakers, and the public are ready to confront the crisis head-on or let history record this as the era when inaction sealed America’s fiscal fate.