Bitcoin has shattered expectations, reaching an all-time high above $100,000 in a dramatic rally fueled by institutional inflows, monetary easing, and speculative momentum. However, as the year-end approaches, the cryptocurrency market faces mounting pressure for a correction, with Bitcoin likely to retreat to levels around $80,000 or even $70,000. Historical seasonality, shifting market sentiment, and institutional behavior suggest that the current rally is running out of steam.

Bitcoin’s Journey to $100K: A Perfect Storm

Bitcoin’s climb above $100,000 was driven by a combination of factors, including central bank rate cuts, heightened institutional adoption, and the broader risk-on environment. The 2024 U.S. elections added fuel to the rally, creating optimism around fiscal stimulus and a weaker dollar, which further bolstered demand for Bitcoin as a store of value.

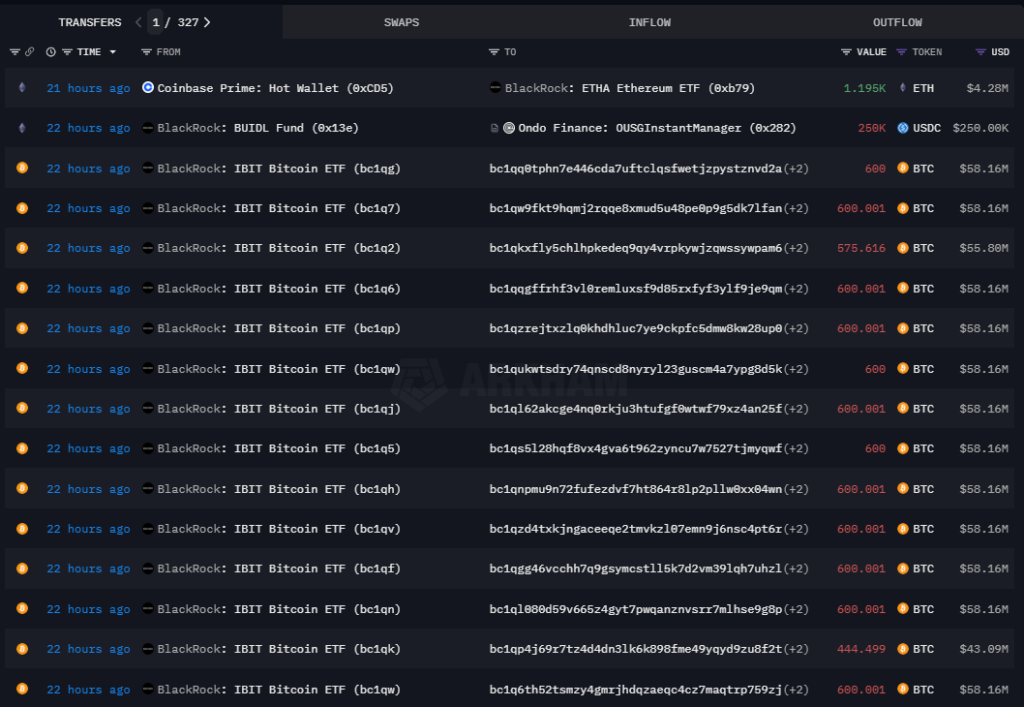

In addition, significant inflows into Bitcoin ETFs from major players like BlackRock provided a strong tailwind for the market. These institutional moves not only legitimized Bitcoin but also added liquidity, propelling prices to record highs.

Seasonality Signals a Selloff

Despite the euphoria, historical patterns point to a high likelihood of a correction. Bitcoin has historically followed a seasonal pattern where Q4 rallies peak in late November or early December, followed by a significant pullback. This pattern reflects profit-taking by institutions and traders seeking to close their books for the year.

As Bitcoin now trades above $100,000, it is entering overbought territory, making it increasingly vulnerable to a sharp reversal. Past cycles show that such corrections can see Bitcoin retrace 20-30%, bringing prices back to the $70,000-$80,000 range.

BlackRock’s Moves Hint at a Shift

Recent blockchain data reveals that BlackRock, one of the largest institutional players in the market, has started reallocating its Bitcoin holdings. Transfers from BlackRock’s Bitcoin ETFs to exchanges suggest large-scale selling, potentially signaling the start of a broader trend.

At the same time, inflows into Ethereum-focused products indicate a strategic pivot toward the second-largest cryptocurrency. This shift reflects growing confidence in Ethereum’s long-term prospects, particularly as the network prepares for major upgrades and institutional adoption accelerates.

The Impact of Election-Year Dynamics

The 2024 U.S. elections played a key role in Bitcoin’s recent rally. Historically, election years have been bullish for speculative assets like cryptocurrencies, driven by expectations of favorable fiscal policies. However, this optimism may have overstretched Bitcoin’s valuation, creating conditions for a pullback.

As the dust settles, market participants are likely to focus on macroeconomic uncertainties, including potential regulatory changes under the incoming administration. These factors could dampen enthusiasm and contribute to a year-end selloff.

What’s Next for Bitcoin?

The coming weeks are expected to bring heightened volatility as Bitcoin faces the dual pressures of profit-taking and seasonal trends. A correction to $80,000 or even $70,000 appears likely, providing an opportunity for long-term investors to accumulate at lower levels.

Ethereum, on the other hand, may emerge as a relative outperformer. Institutional inflows into ETH-focused products suggest that Ethereum’s narrative as a technology-driven investment is gaining traction. As Bitcoin’s dominance potentially declines, Ethereum could capture a larger share of the market’s attention.

Takeoff

Bitcoin’s rise above $100,000 marks a historic milestone, but investors should brace for a correction as the market approaches its seasonal turning point. The expected pullback to $80,000 or $70,000 is part of Bitcoin’s natural market cycle, offering opportunities for those with a long-term outlook. As institutional players like BlackRock diversify into other assets, including Ethereum, the cryptocurrency landscape continues to evolve, requiring investors to stay agile and informed.