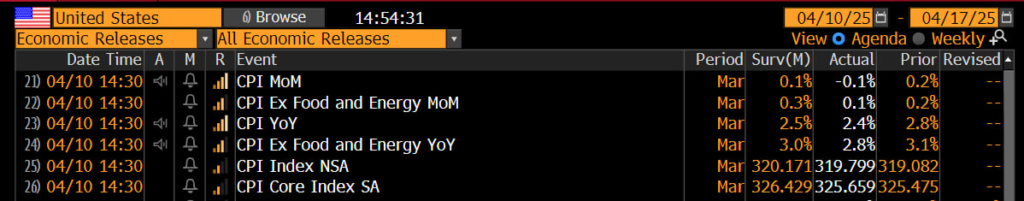

Markets received a critical data point this week: U.S. CPI surprised to the downside across the board. Headline CPI for March came in at -0.1% MoM, well below the expected +0.1%, and YoY inflation slowed to 2.5%. These numbers point to a clear disinflationary trend — one that may be stronger than previously assumed. The significance? The Fed now has renewed space to pivot.

We’re not there yet, but the setup for a new round of monetary easing is quietly taking shape. Brick by brick, the preconditions for QE and rate cuts are being built. The market is beginning to anticipate this — not through headlines, but through positioning.

This week’s sudden equity sell-off wasn’t fundamentally driven. It was fear-based, triggered by volatility spikes and a risk-off knee-jerk to uncertainty. But underneath that move, the macro picture is improving. CPI is cooling. Non-farm payrolls two weeks ago showed robust job creation. And perhaps most critically, jobless claims — one of the best real-time indicators of economic stress — remain extremely low. That’s especially notable given the wave of new jobs recently added. It suggests not only a healthy labor market but also a buffer against the recession narrative.

Looking ahead, the U.S. dollar is likely to appreciate, not because of rate hikes or hawkish policy, but because global capital is positioning for a U.S.-led recovery. With China expected to soften or lift trade tariffs, and the Fed moving toward cuts rather than hikes, the U.S. could reassert itself as the relative bright spot in global markets. That scenario tends to attract foreign capital — and with it, dollar strength.

If that plays out, we are not just moving into a risk-on environment, but potentially the early innings of a broader bullish cycle. But the money isn’t made once the rally is obvious. It’s made on the pivot — when the data starts to shift, positioning is still cautious, and sentiment is uncertain.

Once positive catalysts hit — whether it’s an official rate cut, easing trade tensions, or stronger-than-expected earnings — the capital currently sitting on the sidelines will likely surge back into U.S. markets. That moment may be sooner than many expect.

Disclaimer: This is not financial advice. Always do your own research before making any investment decisions. We are not liable for your losses or gains