The global financial industry has reached a significant milestone with the permanent cessation of LIBOR (London Interbank Offered Rate), effective October 1, 2024. This historic event marks the end of a benchmark that once underpinned approximately $400 trillion in financial contracts worldwide. The transition from LIBOR to alternative reference rates represents one of the most transformative changes in financial market history, aimed at enhancing stability and transparency.

LIBOR’s Legacy and Transition

For decades, LIBOR served as a key reference rate for everything from corporate loans to mortgages. However, concerns over its reliability and susceptibility to manipulation led to a coordinated effort to replace it with more robust benchmarks. This transition was the result of over a decade of collaboration among global regulators, financial institutions, and other stakeholders.

The final phase-out included the cessation of synthetic USD LIBOR settings, which were temporarily maintained to help transition legacy contracts. These synthetic rates, based on the CME Term SOFR Reference Rate plus an adjustment, were never intended for new financial instruments and ceased being representative after September 30, 2024.

What Replaces LIBOR?

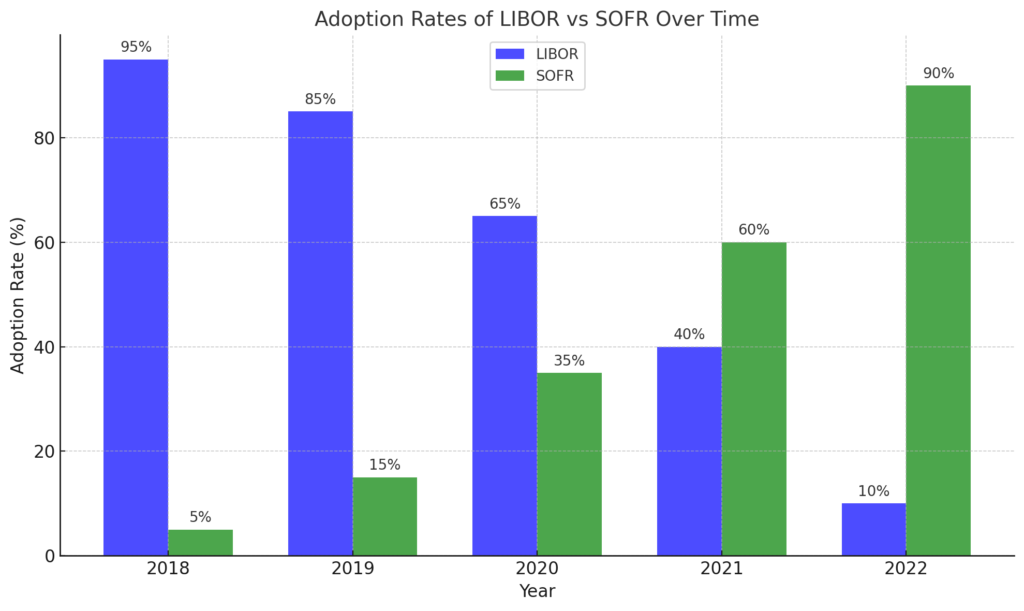

The transition away from LIBOR has introduced alternative reference rates such as the Secured Overnight Financing Rate (SOFR) in the United States and other region-specific benchmarks. These new rates are designed to reduce systemic risks and improve market resilience. Regulators, including the Financial Conduct Authority (FCA) and Financial Policy Committee (FPC), have emphasized that credit-sensitive rates (CSRs) are not suitable as replacements due to their potential to reintroduce financial instability.

Impact on Investors and Borrowers

The LIBOR transition affects a broad spectrum of financial products. Here’s what investors and borrowers need to know:

Securities and Bonds

- Investors holding municipal, corporate, or Federal Home Loan Bank (FHLB) bonds linked to LIBOR should examine issuer disclosures to understand the implications. Resources like the Municipal Securities Rulemaking Board’s EMMA website can provide additional details.

Corporate Disclosures

- Many companies use LIBOR-based derivatives to manage financial risks. Publicly traded companies are expected to outline these risks in their SEC filings (Forms 10-K and 10-Q). Investors can search these reports for “LIBOR” to find relevant updates.

Adjustable-Rate Mortgages (ARMs)

- Adjustable-rate mortgages tied to LIBOR will transition to new benchmarks. Borrowers should review their loan documents and consult with their lenders to understand how their rates will be calculated in the future.

Mutual Funds and ETFs

- Mutual funds and ETFs with exposure to sectors like real estate, banking, or insurance may be affected by the LIBOR transition. Investors should evaluate their portfolios and consult with financial advisors to mitigate potential risks.

Consumer Loans

- Credit cards, auto loans, and personal lines of credit with variable rates tied to LIBOR will also transition to new benchmarks. Consumers should reach out to their lenders for clarity.

What This Means for Financial Markets

The conclusion of LIBOR represents a critical step forward for financial markets. By replacing a rate once associated with manipulation and instability, the global financial system is now better equipped to handle modern challenges. This transition also highlights the industry’s ability to coordinate on complex, large-scale initiatives over extended periods, even amid market volatility.

While the transition has been a significant adjustment for many, it ultimately fosters a safer, more transparent financial ecosystem. As markets continue to adapt, both institutional and retail investors are encouraged to stay informed about the implications of this change on their financial products and investments.

Stay Updated

For more insights on how the LIBOR transition impacts your financial interests, follow our comprehensive coverage. Whether you’re an investor, borrower, or industry professional, staying informed is key to navigating this new era in financial markets.