Navigating tax codes has become an overwhelming challenge for individuals and businesses across the globe. The disparity in the size and complexity of tax codes among countries paints a vivid picture of the bureaucratic burden imposed on taxpayers. From sprawling regulations to concise frameworks, here’s a detailed look at how tax codes vary worldwide and why reform is becoming increasingly urgent.

Tax Code Lengths: A Global Ranking

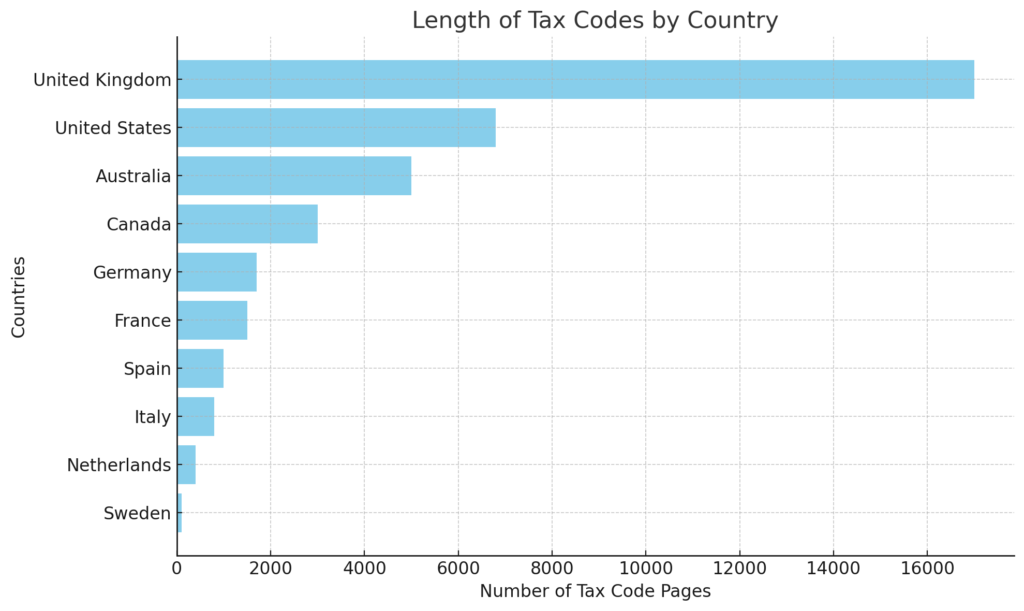

The length of tax codes reflects their complexity and the challenges taxpayers face. Here’s how some of the world’s tax systems compare:

- United Kingdom: 17,000+ pages – the world’s longest tax code.

- United States: 6,800 pages – a mammoth set of rules that has ballooned over decades.

- Australia: 5,000 pages – filled with detailed provisions for individuals and businesses.

- Canada: 3,000 pages – challenging, but less daunting than many others.

- Germany: 1,700 pages – detailed and efficient but still substantial.

- France: 1,500 pages – slightly smaller but still filled with complexities.

- Spain: 1,000 pages – much shorter yet still intricate.

- Italy: 800 pages – a relatively concise code but not without flaws.

- Netherlands: 400 pages – short and streamlined compared to its peers.

- Sweden: 100 pages – the simplest and most accessible tax system in this ranking.

The United States: From Simplicity to Overload

The US tax code stands as a prime example of how a well-intentioned system can spiral into a labyrinth. The Tax Reform Act of 1986, signed by President Ronald Reagan, initially simplified the code by reducing rates and eliminating many loopholes. However, over the years, these loopholes returned, accompanied by new layers of complexity.

Today, the US tax code is 75,000 pages long when accounting for associated rules and regulations, leaving taxpayers overwhelmed:

- The average taxpayer spends 13 hours preparing their tax return.

- 80% of taxpayers rely on paid preparers or software, highlighting the system’s complexity.

- The US faces a $625 billion tax gap annually, stemming from errors and underpayment.

- Tax breaks cost over $1.1 trillion annually, contributing to deficits and record debt.

The United Kingdom: A Maze of Reliefs and Exemptions

The UK tax code holds the unenviable title of the world’s longest, spanning over 17,000 pages. Constant updates and a myriad of reliefs and allowances add to the complexity, making it difficult for both individuals and businesses to navigate. While reliefs aim to offer fairness, they often result in confusion and inefficiency.

The Case for Simplification

Tax simplification offers clear benefits:

- Reduced compliance costs: Simplified rules save time and money for taxpayers and businesses.

- Improved compliance: Easier systems encourage accuracy and transparency.

- Lower fraud and evasion: Clarity reduces opportunities for manipulation.

Estonia provides a compelling example. Ranked as the world’s most competitive tax code, it features simple flat rates and a property tax focused on land value, ensuring fairness and efficiency.

Global Tax Competitiveness

The Tax Foundation’s ranking of global tax codes highlights key differences:

- Estonia: The most competitive tax code globally, with a 20% flat rate and a straightforward structure.

- Germany and the UK: Praised for generous corporate investment incentives.

- Italy and France: Criticized for distortionary taxes and inefficiencies.

- Czechia: Recently slipped in competitiveness due to increased corporate tax rates.

While some countries move toward simplification and competitiveness, others remain bogged down by convoluted systems.

Finding Balance: Simplicity vs. Competitiveness

The growing complexity of tax codes worldwide raises concerns about their economic impact. Simplifying tax systems is not just about easing taxpayer frustration but also about fostering sustainable growth, reducing deficits, and ensuring fairness. Competitive tax systems, like Estonia’s, provide a model for others to follow.

Conclusion: A Clearer Path Forward

The disparity in tax code lengths underscores the urgent need for reform. Whether it’s the UK’s sprawling 17,000 pages or Sweden’s concise 100-page framework, the lesson is clear: simplicity benefits everyone. By streamlining their tax systems, governments can improve compliance, foster growth, and create a more equitable environment for taxpayers. As countries like Estonia demonstrate, simplicity and competitiveness can go hand in hand.

One response to “The Tax Code Labyrinth: Ranking Countries by Length and Complexity”

I have argued this case for about 14 years since talking to a former partner in PWC. He intimated that his entire career might have been based on an immoral premise as his job was to help big corporations choose what level of tax to pay. He explained to me about the relative complexity of the UK’s code but pointed out that this was a political choice or the result of series of choices by governments of both complexions. No British politician wants to grasp the nettle of simplification of the tax code.