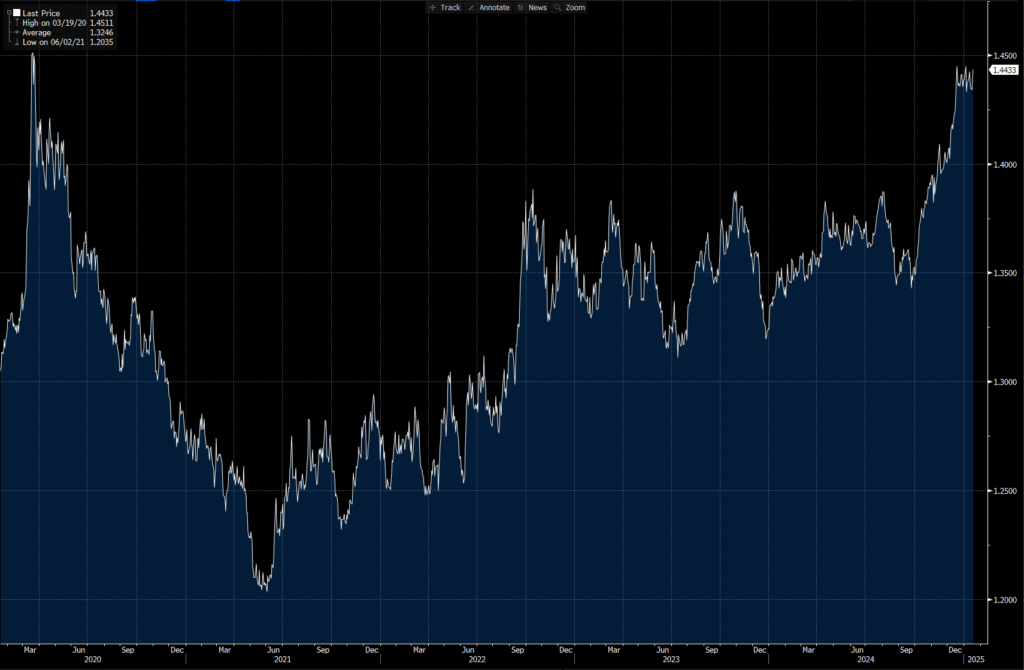

As overnight futures hint at a calm before the storm, financial markets appear to be preparing for significant upheaval. Donald Trump’s imminent return to the White House has sparked expectations of over 100 executive orders, with tariffs topping the list of market concerns. The potential for substantial policy shifts is already influencing global currency markets, particularly USD/CAD and USD/MXN, which have shown resilience despite recent dips in U.S. bond yields.

Anticipated Market Volatility

Trump’s inauguration coincides with Martin Luther King Jr. Day, a U.S. market holiday, which adds a layer of complexity. The possibility of day-one announcements introduces “gap risk” for U.S. equities. However, global FX markets, which operate continuously, could see amplified volatility given lower-than-usual liquidity during the holiday. Traders may adjust their positions in anticipation, but the markets may have already priced in the chaos that Trump’s return could unleash. Any surprises would likely further amplify market moves.

Bond and Equity Market Dynamics

Thursday’s comments from Federal Reserve officials, including Christopher Waller, sparked another round of bull flattening in the U.S. Treasury yield curve. This continues the reversal of December’s steepening trend, with short-term yields declining more sharply than long-term rates. Meanwhile, equity market trends show the equal-weighted S&P 500 (SPW) outperforming the standard S&P 500 (SPX). This signals that positioning adjustments in portfolios may have been underway for weeks, aligning with broader market expectations for next week’s developments.

Implications for Traders and Investors

With the FX market bracing for a volatile week and the bond market signaling cautious optimism, traders must prepare for sudden shifts. The combination of new executive orders, potential tariff announcements, and the unpredictable timing of policy shifts could create opportunities for those able to navigate the turbulence.