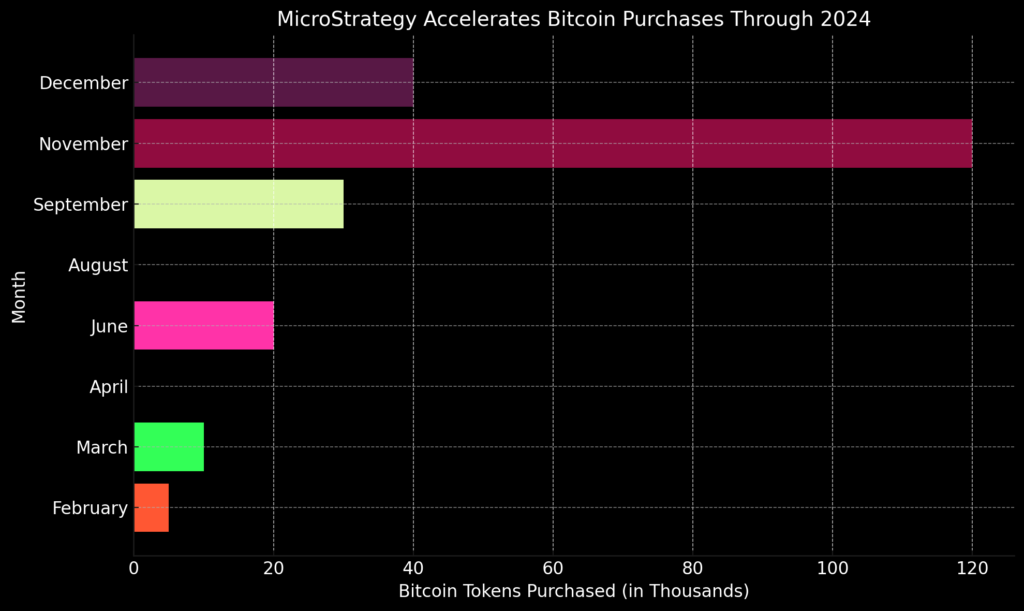

MicroStrategy, a company once known for its business software, has become one of the biggest corporate investors in Bitcoin. Last week alone, it spent $2.1 billion to buy an additional 21,550 Bitcoin, bringing its total holdings to over 400,000 tokens. With a current value exceeding $41 billion, this bold strategy has made headlines across the financial world.

This isn’t the first time the company has made big Bitcoin moves. Led by Chairman Michael Saylor, MicroStrategy began shifting its focus to cryptocurrency a few years ago. Saylor argues that Bitcoin is a better long-term investment than traditional business strategies. To fund these purchases, the company has turned to a mix of selling shares and raising money through loans, planning to gather $42 billion over the next three years to continue buying Bitcoin.

While the strategy has worked well during Bitcoin’s price surge, it’s not without risks. Critics are concerned that MicroStrategy is putting all its eggs in one basket. If Bitcoin’s value were to drop significantly, the company could struggle to pay off its debts. Some analysts also point out that with so much Bitcoin under its control, any large sell-off by MicroStrategy could impact the entire cryptocurrency market.

Despite these concerns, MicroStrategy’s stock has soared by more than 500% this year, fueled by excitement over its Bitcoin holdings. Investors see the company as a proxy for betting on the cryptocurrency itself. Hedge funds, in particular, have snapped up MicroStrategy’s convertible debt, using market-neutral strategies that take advantage of Bitcoin’s volatility.

For now, the company is riding high, with both Bitcoin prices and its stock climbing steadily. However, the future remains uncertain. As one analyst put it, “This strategy works well during a bull market, but it depends entirely on Bitcoin continuing to rise. A significant drop could create serious challenges for the company.”

MicroStrategy acknowledges the risks. In recent filings, the company warned that falling Bitcoin prices could hurt its financial health and limit its ability to raise cash. Even so, Michael Saylor remains confident in his approach, calling Bitcoin “the future of money.”

Only time will tell whether this bold bet pays off. For now, MicroStrategy continues to lead the charge among companies investing heavily in cryptocurrency, setting an example for both the rewards and risks of diving into the volatile world of Bitcoin.