The obesity treatment industry is expanding rapidly, creating a significant opportunity for investors. Companies like Novo Nordisk and Eli Lilly have taken the lead in addressing the growing global obesity epidemic with groundbreaking drugs like Ozempic, Wegovy, Zepbound, and Mounjaro. These treatments have driven massive revenue growth, and analysts expect this trend to accelerate as the demand for effective weight-loss solutions rises.

More Options for Patients by 2027

By 2025, results from dozens of clinical trials for obesity medications will be released, potentially introducing up to 12 new drugs by 2027. With obesity affecting over 1 billion people worldwide, the market for these treatments is expected to grow to an estimated $50 billion annually, according to Bloomberg Intelligence. Companies are racing to develop drugs with better efficacy, fewer side effects, and more convenient dosing schedules, like monthly injections instead of weekly ones.

This growth in obesity treatments isn’t just good news for patients—it’s a game-changer for the stock market. Pharmaceutical companies pioneering these therapies are poised to see significant gains as demand skyrockets.

Growth Rates Driving Stock Market Potential

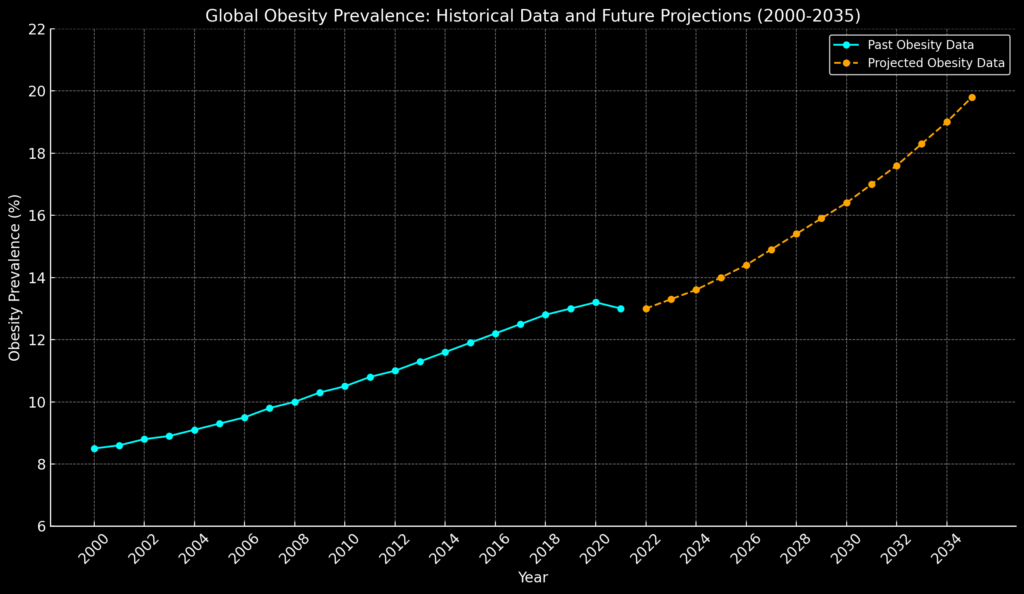

The obesity epidemic has seen a steady rise globally, with rates increasing year over year. This has translated into higher spending on obesity-related healthcare and treatments. Novo Nordisk and Eli Lilly have already benefited significantly, with analysts projecting their weight-loss drug franchises to contribute substantially to earnings by 2025.

- Novo Nordisk’s stock has soared as sales of Wegovy and Ozempic continue to break records. Analysts expect continued growth as the company explores next-generation drugs like CagriSema, which could help patients lose up to 25% of their body weight.

- Eli Lilly’s stock has also surged, driven by the success of Mounjaro and promising results from its next-generation drug, Retatrutide, which achieved a 24% average weight reduction in trials.

The introduction of competing drugs, such as Amgen’s MariTide, which offers monthly dosing, highlights the growing market competition. Although MariTide faced skepticism for not significantly outperforming existing treatments, the competition is expected to fuel innovation, benefiting both patients and investors.

Why the Market is Watching Closely

The global obesity treatment market is not just large—it’s expanding rapidly. As new drugs are developed, the industry is expected to diversify, opening opportunities for both established pharmaceutical giants and smaller biotech companies. Investors are keeping a close eye on companies conducting clinical trials, as successful results could lead to sharp stock price increases.

How Investors Can Benefit

- Established Leaders: Investing in companies like Novo Nordisk and Eli Lilly provides exposure to proven market leaders with a track record of success in obesity treatments.

- Emerging Players: Smaller biotech firms with innovative approaches could offer significant upside potential, though with higher risk.

- Broader Healthcare ETFs: For diversified exposure, healthcare-focused ETFs that include major obesity treatment players can be an attractive option.

The Future is Bright for Obesity Treatments

The rising prevalence of obesity worldwide ensures sustained demand for effective solutions, making this sector a promising long-term investment. As companies continue to innovate, introducing new treatments that cater to diverse patient needs, the market is poised for significant growth—both in terms of healthcare impact and stock market returns.

For investors, the obesity epidemic is not just a health crisis; it’s an opportunity to participate in a rapidly growing industry with the potential to deliver strong financial returns.