Tag: INVESTING

-

Goldman Sachs Backs Cameco as Nuclear Energy Gains Momentum

Goldman Sachs is renewing its bullish position on Cameco Corporation, a major force in the nuclear fuel industry. With a firm ‘Buy’ rating reaffirmed by analyst Brian Lee, the bank is clearly signaling confidence in both Cameco’s potential and the broader prospects of nuclear power. This strategic endorsement also extends to small modular reactors (SMRs),…

-

Warren Buffett Steps Down: Greg Abel Takes the Helm

The investment world is buzzing with excitement and a touch of nostalgia as the legendary Warren Buffett, the “Oracle of Omaha,” announced that he is set to pass the baton of Berkshire Hathaway’s CEO to Greg Abel, his trusted confidant and chosen successor. For decades, Buffett has been the charismatic face of the company, guiding…

-

The Medallion Fund: Unmatched Returns and a Rare Setback

The Medallion Fund, managed by Renaissance Technologies, is widely considered the most successful hedge fund in history. Since its inception in 1988, it has delivered an unmatched average annual return of 66% before fees and 39% after fees, outperforming investment legends like Warren Buffett and George Soros. Its success is rooted in a 100% algorithmic…

-

U.S. Reciprocal Tariffs Are Strategic, Not Chaotic: A Bullish Opportunity

The recent U.S. announcement of reciprocal tariffs has stirred global headlines, prompting concerns of a trade war revival. But look closer, and it’s evident this isn’t about chaos—it’s calculated. The markets, bond yields, and macro data all point in one direction: this is a tactical move designed to pressure the Federal Reserve to cut rates,…

-

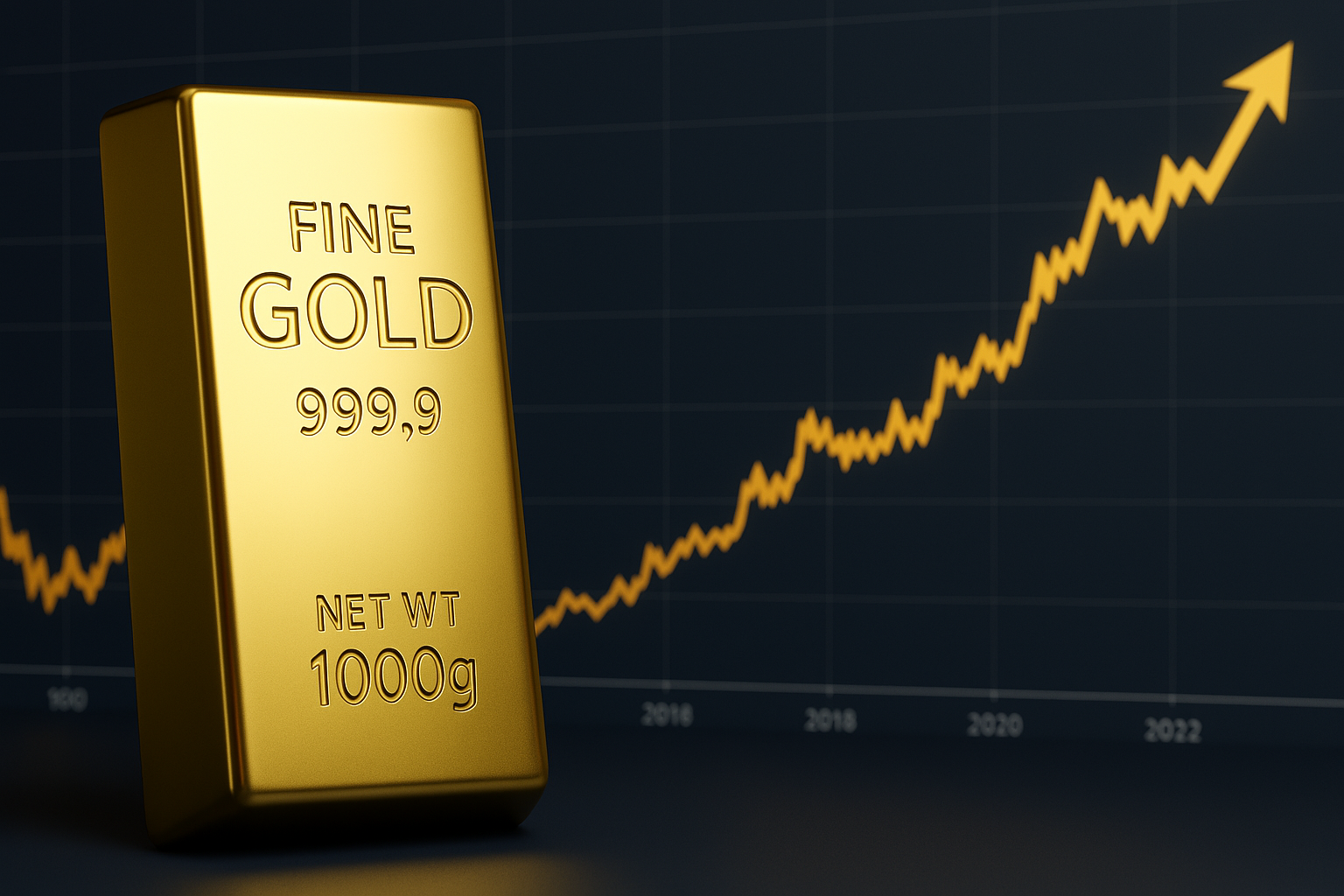

Gold’s Shining Pattern: Will 2024 Mirror 2008?

Gold’s journey through modern financial history tells a compelling story—one marked by calm during economic clarity and brilliance during financial turmoil. In 2000, gold was barely on anyone’s radar, averaging just $270 per ounce. Fast forward to 2008, during the peak of the global financial crisis, it climbed past $870 and soared beyond $1,000 in…

-

U.S. Market Rebounds as CPI Data Beats Expectations: A Buying Opportunity?

The U.S. stock market is seeing a strong rebound in futures and pre-market trading following a better-than-expected Consumer Price Index (CPI) report. Inflation data came in lower than anticipated, easing investor concerns about the Federal Reserve’s interest rate path. This has fueled optimism among traders, driving up futures contracts on major indices such as the…

-

Trump Tariffs 2.0 vs. 1.0 – How the S&P 500 is Reacting Now

The market’s reaction to tariff implementations has been a significant indicator of investor sentiment and economic expectations. The chart comparing Trump 1.0 and Trump 2.0 tariffs showcases a clear correlation between the imposition of tariffs and S&P 500 daily returns, with the latter period appearing to be more volatile and reactive. Tariff 1.0: The 2018…