Tag: TARIFFS

-

China Hikes Tariffs on US Goods to 125%, Hints Trade War May Be Nearing a Resolution

China announced it will raise tariffs on all US goods to 125% starting April 12, escalating its response to Washington’s earlier decision to lift tariffs on Chinese imports to 145%. The move, confirmed by the Ministry of Finance on Friday, marks a significant intensification of the trade dispute but also hints that tensions may have…

-

Pharmaceutical Giants Warn Europe of Large Investment to the US

Pharmaceutical companies are sounding the alarm to the European Commission, warning of a potential investment exodus to the United States if proposed tariffs are implemented. This stark message, backed by a survey of 18 major international firms, suggests that 85% of their capital expenditure and 50% of their R&D budgets—estimated at $112.9 billion—are at risk…

-

Can China Lower Labor Costs to Offset U.S. Tariffs?

China’s manufacturing strength has long been anchored in its vast labor force, once able to provide low-cost production at massive scale. With rising U.S. tariffs raising the price of Chinese goods abroad, especially in America, it’s natural to ask: could China simply lower labor costs again to remain competitive? On the surface, the idea appears…

-

The End of Globalization as We Knew It: A Rebirth of Sovereignty

The imposition of tariffs by Donald Trump was more than a headline-grabbing policy—it was a shockwave across decades of economic doctrine. It marked the unraveling of a global order that prioritized cheap production over domestic strength. The goal? To bring back manufacturing, reclaim industrial sovereignty, and restore dignity to those sidelined by the paper-thin promises…

-

U.S. Reciprocal Tariffs Are Strategic, Not Chaotic: A Bullish Opportunity

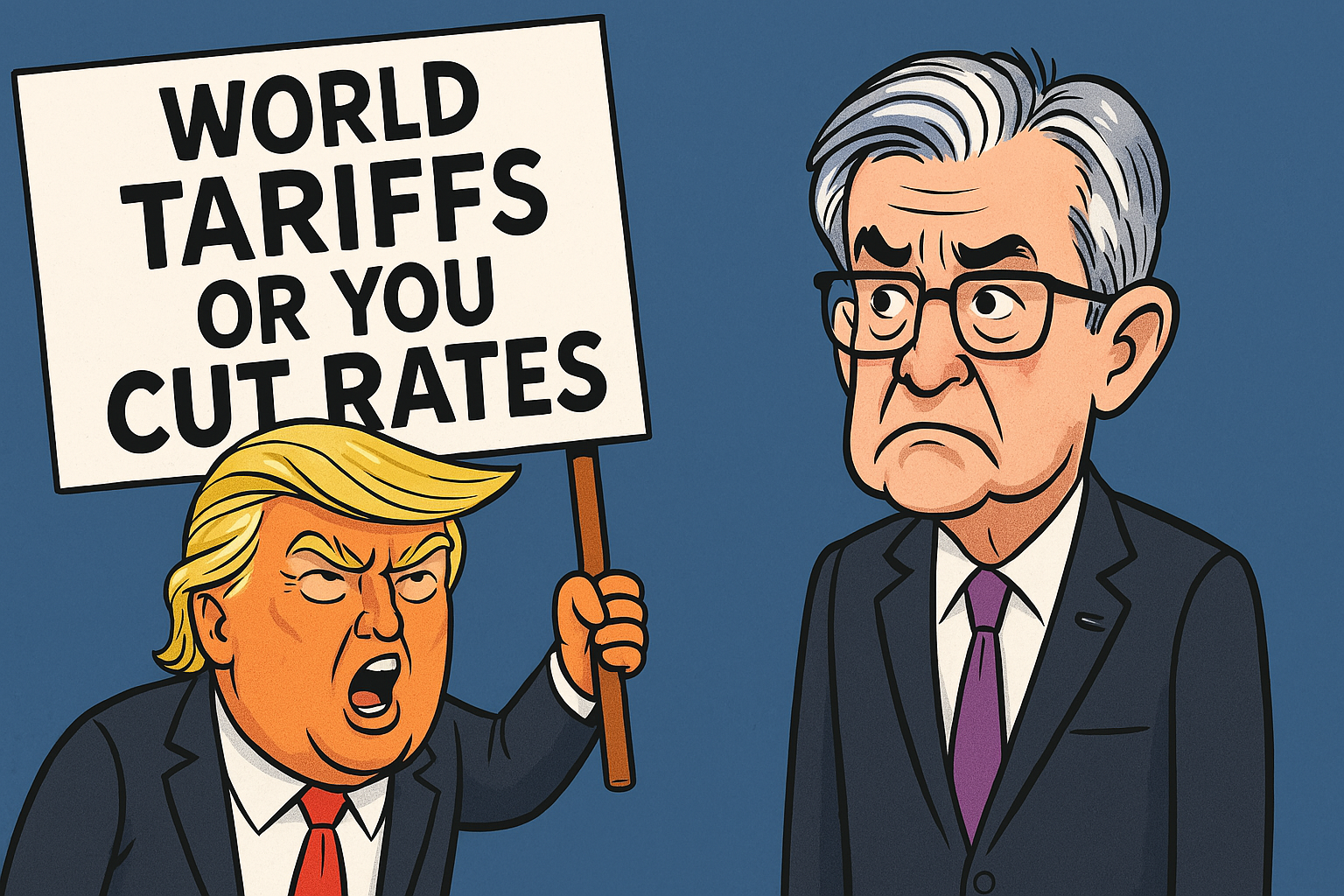

The recent U.S. announcement of reciprocal tariffs has stirred global headlines, prompting concerns of a trade war revival. But look closer, and it’s evident this isn’t about chaos—it’s calculated. The markets, bond yields, and macro data all point in one direction: this is a tactical move designed to pressure the Federal Reserve to cut rates,…

-

Trump Tariffs 2.0 vs. 1.0 – How the S&P 500 is Reacting Now

The market’s reaction to tariff implementations has been a significant indicator of investor sentiment and economic expectations. The chart comparing Trump 1.0 and Trump 2.0 tariffs showcases a clear correlation between the imposition of tariffs and S&P 500 daily returns, with the latter period appearing to be more volatile and reactive. Tariff 1.0: The 2018…

-

Stephen Miran’s Economic Vision: Tariffs, Trade, and Dollar Depreciation

Stephen Miran, nominated by Donald Trump as chairman of the Council of Economic Advisers, has put forward a distinctive economic strategy focused on tariffs, currency valuation, and burden-sharing among trade partners. His proposals aim to reindustrialize the U.S., strengthen its economic position, and reshape global trade dynamics. Miran views tariffs as a negotiating tool, using…

-

Massive Gold Exodus: Why the Bank of England’s Gold is Heading to the US

Recent reports have unveiled a major surge in gold shipments from the Bank of England to the United States. Commercial flights from London to the US are reportedly carrying between two to four tons of gold each, marking an intense rush to move bullion across the Atlantic. Several key factors are driving this unprecedented movement.…

-

Temu & Shein Face New Tariffs: What It Means for Shoppers

The de minimis exemption has long provided e-commerce giants like Temu and Shein with a way to ship large volumes of small packages into the U.S. without incurring tariffs. Under this policy, goods valued at $800 or less have been able to enter the country duty-free, allowing these companies to maintain a competitive edge over…

-

Trump’s 100% Tariff Threat: A Bold Move or a Catalyst for De-Dollarization?

Donald Trump’s recent threat to impose 100% tariffs on BRICS nations if they move away from the U.S. dollar has reignited tensions over America’s economic dominance. For decades, the U.S. dollar has been the backbone of global trade, largely due to the strength of the American economy and its central role in commodities like oil.…