Tag: TRUMP

-

Elon Musk’s Exit from DOGE: What It Means for U.S. Fiscal Policy

Elon Musk’s departure from the Department of Government Efficiency (DOGE) marks a turning point for the Trump administration’s fiscal policy. As Musk steps down at the end of May, questions are being raised about the future direction of a department that has reportedly delivered $1 trillion in deficit reduction and $130 billion in taxpayer savings.…

-

The U.S. Sovereign Wealth Fund: A Game-Changer for Economic Stability or a Risky Bet?

President Donald Trump has signed an executive order directing the U.S. Treasury and Commerce Departments to initiate the creation of a U.S. Sovereign Wealth Fund (SWF). This move could redefine America’s economic strategy, drawing inspiration from successful sovereign wealth funds in countries like Norway, Singapore, and China. These state-owned investment funds typically invest in assets…

-

Trump’s 100% Tariff Threat: A Bold Move or a Catalyst for De-Dollarization?

Donald Trump’s recent threat to impose 100% tariffs on BRICS nations if they move away from the U.S. dollar has reignited tensions over America’s economic dominance. For decades, the U.S. dollar has been the backbone of global trade, largely due to the strength of the American economy and its central role in commodities like oil.…

-

Trump Blocks Digital Dollar: Safeguarding Privacy and Shaping the Future of U.S. Finance

In a bold move aligning with the longstanding views of many Congressional Republicans, U.S. President Donald Trump issued an executive order prohibiting the creation of a Central Bank Digital Currency (CBDC). The decision underscores concerns about financial system stability, individual privacy, and national sovereignty, halting the development, issuance, and circulation of a CBDC within U.S.…

-

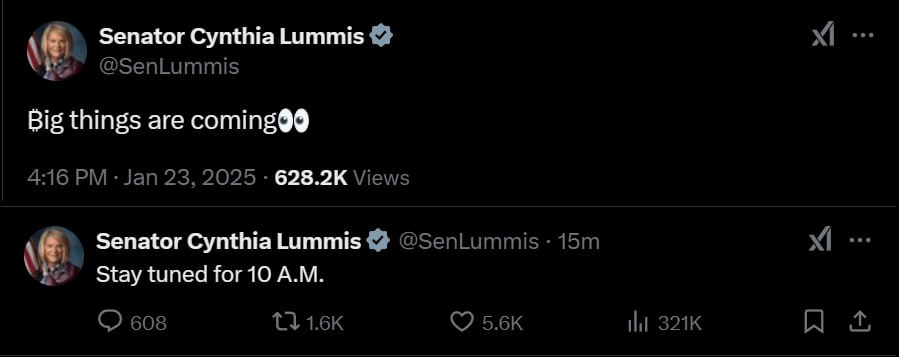

Ross Ulbricht’s Pardon and Trump’s Economic Strategy: Speculations Rise Over Silk Road Seizures and Reserve Plan

On January 23, 2025, Senator Cynthia Lummis hinted at major developments with her cryptic tweet, “Big things are coming 👀,” followed shortly by, “Stay tuned for 10 A.M.” This announcement coincides with heightened speculation about the potential pardoning of Ross Ulbricht, the Silk Road founder, and its ties to the U.S. government’s financial maneuvers. With…

-

Can Bitcoin Solve the U.S. National Debt Crisis?

President Donald Trump recently proposed using Bitcoin to tackle the United States’ monumental $35 trillion national debt. While this suggestion has sparked excitement among cryptocurrency advocates, it has also raised serious questions about its feasibility and potential implications. Could Bitcoin be a viable solution, or is this merely an innovative but impractical idea? The Case…

-

Brace for Market Shake-Up with Trump’s Inauguration

As overnight futures hint at a calm before the storm, financial markets appear to be preparing for significant upheaval. Donald Trump’s imminent return to the White House has sparked expectations of over 100 executive orders, with tariffs topping the list of market concerns. The potential for substantial policy shifts is already influencing global currency markets,…

-

JPMorgan Chase CEO’s Take on Economic Policy and Tariffs

In a recent conversation with CBS News, Jamie Dimon, CEO of JPMorgan Chase, expressed his concerns about the current state of U.S. economic and political policies. Dimon emphasized the need for reforms to boost growth and prosperity for working-class Americans, criticizing the Biden administration’s policies on immigration, national security, and supply chain diversity. He also…

-

Monroe Doctrine Revival: How Trump’s Foreign Policy Targets China, Russia, and Latin America

Donald Trump has reignited interest in the Monroe Doctrine as a guiding principle for U.S. foreign policy, especially in countering foreign influence in the Western Hemisphere. This strategy highlights the growing competition between the U.S. and external powers, notably China and Russia. A Renewed Focus on Latin America Trump’s administration has openly embraced the Monroe…