The U.S. housing market is witnessing a significant rise in home builder speculative (spec) inventory, nearing levels observed during the 2008 housing bubble. Spec homes—properties built without a committed buyer—have become a critical factor in market dynamics. Let’s break down the current situation compared to the 2008 crisis and assess its potential implications.

Comparing Inventory Levels: Then and Now

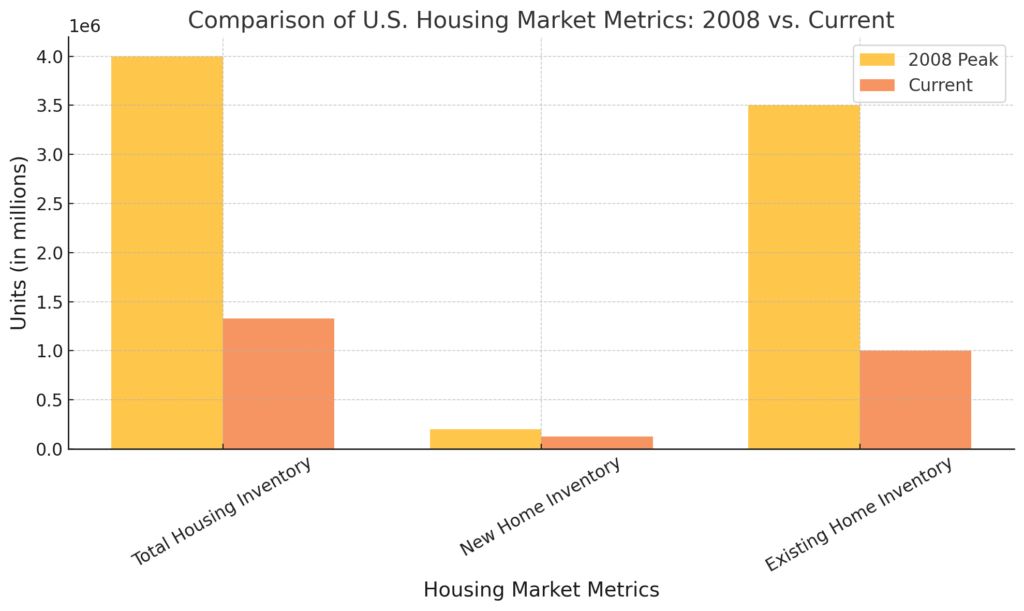

- Total Housing Inventory

In 2008, the housing market reached an oversupply of over 4 million homes. While today’s figure of approximately 1.33 million homes for sale is far lower, it marks an increase from the historically low levels of recent years. - New Home Inventory

Spec home construction has surged, with nearly 124,000 new homes built without buyers. Although this is below the 2008 peak of about 199,000, the “Months of Supply” metric has climbed to nearly 9 months in some regions, resembling 2008 levels. This points to a growing backlog of unsold new construction. - Existing Home Inventory

The current market for existing homes is tight, with around 1 million available properties, contrasting sharply with the over 3.5 million seen in 2008. This reduced supply of existing homes supports stronger pricing in this segment. - Months of Supply

In 2008, the months of supply peaked at over 11, signaling severe market imbalance. Today, the national average is around 2.9 months, indicating a seller’s market overall, though regional differences exist.

Economic and Lending Differences

One of the most significant contrasts between now and 2008 lies in lending standards. The mid-2000s were notorious for lax lending practices, contributing to widespread defaults and the eventual housing crash. Today’s stricter lending criteria reduce the risk of a similar crash, as the market is underpinned by more financially stable buyers.

Regional Disparities and Risk Factors

The increase in spec homes has been driven by builders responding to a prior demand surge. However, some regions face oversupply, particularly where new constructions continued despite slowing demand. Higher interest rates and economic uncertainty have further dampened buying activity, raising concerns about localized price corrections or market slowdowns.

A Different Context, but Watch for Warning Signs

While parallels to 2008 exist, particularly in new home inventory, other factors such as tighter lending standards and reduced existing home supply differentiate the current market. These elements may help mitigate the severity of a potential correction. However, the rising spec inventory warrants close monitoring, as an imbalance between supply and demand could lead to price adjustments.

Looking Ahead

The housing market today reflects a complex interplay of supply, demand, and broader economic conditions, including rising interest rates and shifting demographics. While a bubble burst like 2008 is less likely, the market is evolving towards greater balance, potentially giving buyers more negotiating power and stabilizing home prices in certain regions.