The latest U.S. labor market update brings a mix of positive and challenging news, creating potential opportunities for small-cap companies. These businesses, often more sensitive to economic changes, could benefit from recent trends as the Federal Reserve moves toward cutting interest rates.

What the Numbers Say

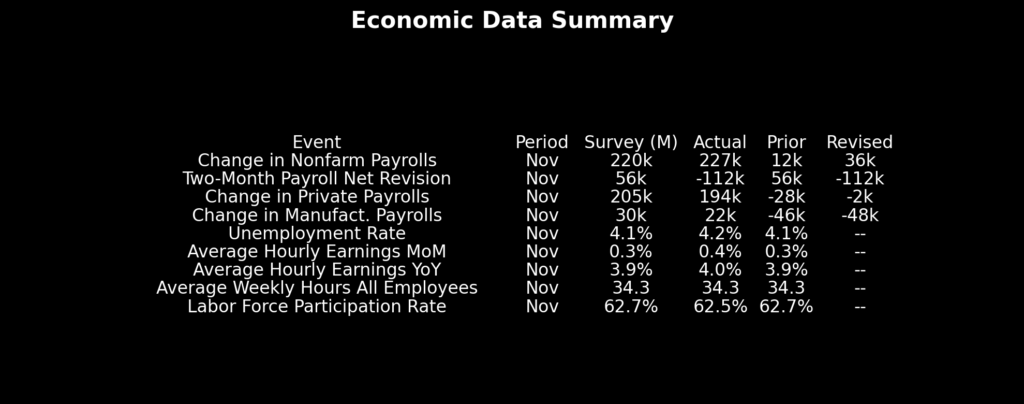

- Jobs Added: 227,000 in November, slightly above expectations. October’s weaker numbers, affected by strikes and storms, were revised up to 36,000.

- Unemployment Rate: Rose to 4.2%, the highest in nearly three years, hinting at a cooling job market.

- Wages: Average hourly earnings increased by 4% compared to last year, holding steady from October.

Labor Market Highlights

Industries like healthcare, leisure, and government led the hiring surge, while retail saw significant job cuts. Long-term unemployment, or those out of work for 27 weeks or more, climbed to the highest levels since early 2021. The participation rate, which measures the share of people working or looking for work, fell slightly to 62.5%.

Fed Policy and Small Caps

The Federal Reserve is likely to continue cutting interest rates, with another reduction expected in December. Lower rates typically reduce borrowing costs, a major benefit for small-cap companies that rely on affordable credit to grow. Additionally, small caps tend to perform well during periods of domestic economic resilience, making them an attractive option for investors in this environment.

Market Reactions

The job report has sparked optimism in financial markets. Stocks rose at the opening bell, and Treasury yields dropped as investors priced in further Fed action. Small caps, known for their agility in adapting to economic shifts, stand out as potential winners in this climate.

What’s Next?

While the rising unemployment rate reflects a labor market losing some momentum, the broader economic environment could favor small-cap businesses. Lower interest rates and steady domestic demand are expected to provide them with a growth edge.

For investors, this could be an opportune time to explore small-cap stocks as the Federal Reserve takes steps to support the economy and stabilize employment trends.